You are viewing the article Car Accident Settlement Amounts in 2022 (Personal Injury) at Lassho.edu.vn you can quickly access the necessary information in the table of contents of the article below.

Below, you’ll see several of our car and auto accident settlements. These include settlements with State Farm, GEICO, Progressive and many other insurance companies.

These car accident settlements are from 2022 and other years.

You’ll even get to see several real settlement checks. I’ll tell you what the average car accident injury settlement is.

But I don’t stop there.

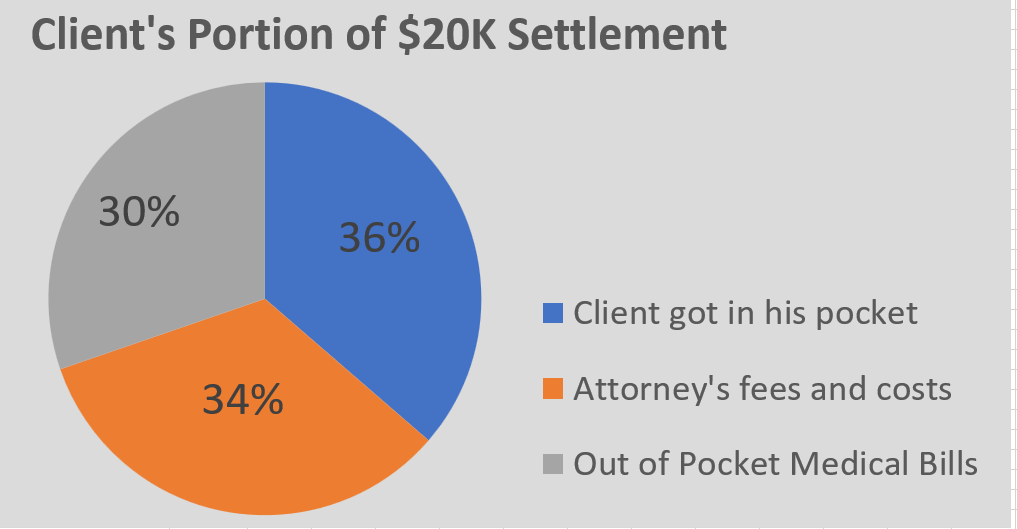

In many of these settlement stories, you’ll see how much my client actually got in his or her pocket after my attorney’s fees and we paid their medical bills. This is different from most other car accident settlement stories online. Many of those do not say how much the client got in their pocket.

Before we get to my settlements, I want to go over a few frequently asked questions (FAQ)about car accident settlements. Here are a few:

This is a tough question to answer without knowing all of the details. Car accident settlements can vary greatly based upon many factors.

The seriousness of the injury is often one of the biggest factors that determines settlement. For example, if you’re badly injured in a car accident may get a $300,000 payout. On the other hand, if you have minor injuries you may only get $2,000.

Another big factor that often determines how much to settle for is the amount of available insurance coverage. For example, I settled a broken leg car accident case for $325,000. In that case, there was plenty of insurance coverage available.

Yet, I settled another leg fracture case for only $10,000. The reason?

There was limited bodily injury liability coverage.

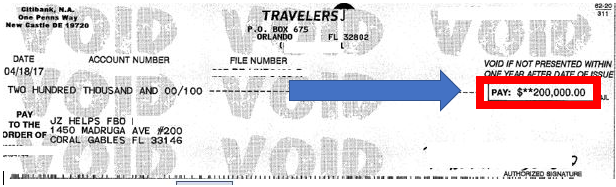

You should hire an attorney because he or she can look for all available insurance coverage. There may be coverage that you have no idea exists. In one case, I discovered an additional $100,000 in bodily injury liability coverage.

The result?

We settled for $200,000 instead of $100,000.

In sum, the amount that you should settle for depends greatly on the facts of the case. Here is my client’s car from the $200,000 settlement that I mentioned:

It depends on the how much pain and suffering you’ve experienced. Basically, it is based on how badly you are injured.

That said, you (or your attorney) can ask the insurance company to make you a fair offer. You (or your lawyer) do not have to demand a certain amount for pain and suffering.

I’ve settled many cases where I asked the insurance company or responsible party to make a fair offer. Basically, I asked them to include a reasonable amount for pain and suffering damages. In fact, I’ve settled cases for over $300,000 where I did not ask for a specific amount for pain and suffering.

Here’s the problem:

If you don’t know how much your pain and suffering is worth in a car accident case, you won’t know what is fair to accept. And if you don’t know what is fair, you’ll have no idea if the insurance company is making you a very small offer.

Generally speaking, you should only demand a certain amount for pain and suffering if you know how to value a car accident case. And estimating a case value is not easy. It comes with a decade (or more) of experience.

For example, in a bad leg fracture case, I may ask for $295,000 in pain and suffering. Maybe more. Perhaps less. In the photo below, my client had a bad leg fracture. We settled for $300K.

If you are injured, and someone else is at fault in your car accident, you may be entitled to compensation. You (or your lawyer) needs to gather all of your medical bills and records.

Next, you need to make a spreadsheet (chart) showing your total billed charges and the amounts still owed. If you have an attorney, he or she will do this for you.

Look to see if your health or auto insurance company is also entitled to get paid back from your settlement. If so, you can factor this amount into any potential car accident settlement.

Do your research as to how much your injuries are worth. This is the toughest part of the case. Values vary from county to county. Attorneys know values from years of experience settling past cases.

If you’ve missed work due to the car accident, you need to document your lost wages. Ask your employer to complete a 13 week wage and salary verification statement. This can be used to prove your lost wages.

The above is an oversimplification of how car accident settlements work. Many attorneys dedicate their lives to understanding how to get the biggest settlement. Do yourself a favor and hire one. You won’t regret it.

First, you need to have a big injury. Of course, you don’t want to be badly injured. However, having a big injury is the first step to getting the most money from an auto accident.

As soon as possible, you (or your lawyer) needs to preserve any evidence. This includes, preserving any event data recorders (“black boxes”) in the vehicles. If you do not have the evidence that you need to prove your case, don’t expect to get a a lot of money.

Also, make sure to follow up with any medical treatment that you need. If you have serious pain, tell a doctor about it. If your doctor does not document your injury in your medical records, do not expect a big payout.

You need to know how much your case is worth in order to get the most money possible. This is the toughest step for someone without a lawyer. It can take a decade (10 years) of experience to truly learn the amount that you should accept as settlement.

If you do not know the fair settlement value, you will never know if the insurance company is offering you all of the money that they have set aside to pay your claim. This could result in you leaving hundreds of thousands of dollars on the table!

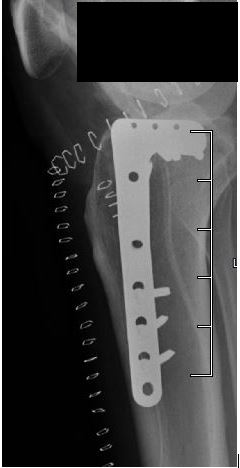

As an example, my client broke his ankle when a car hit him while he was riding a bike. A broken ankle (with surgery) is a serious injury. In 2021, I settled his case for $350,000. You can see the plate and screws in his ankle:

To calculate how much an car accident case is worth, you add out of pocket medical bills (and liens), pain, suffering and lost wages.

Next, you reduce this total value by your percentage of fault. For example, if you were 50% at fault for causing the accident, you reduce this total value by 50%.

If you were not at fault, you do not reduce the total settlement value.

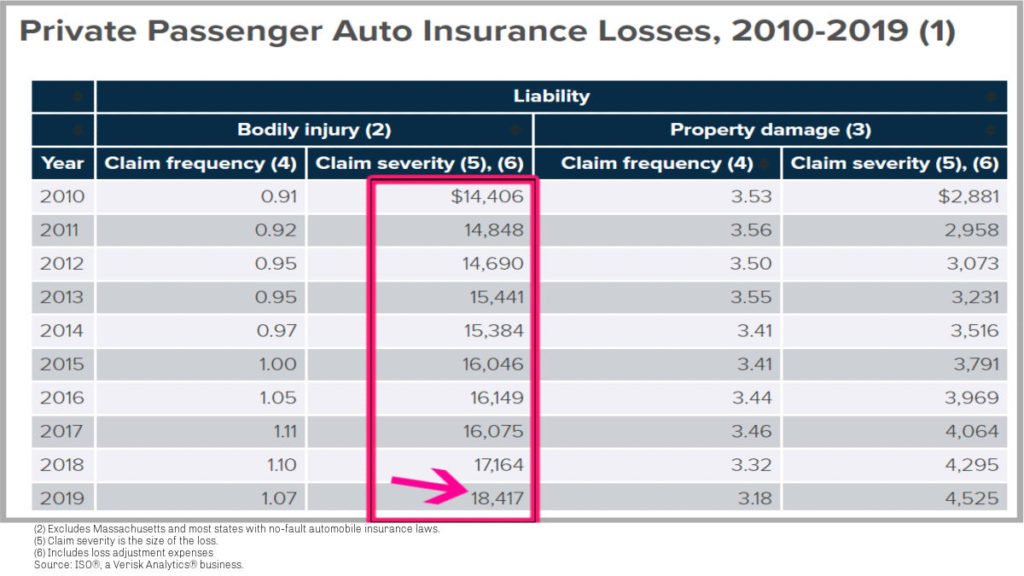

What is the average car accident injury settlement amount?

According to ISO, a Verisk Analytics business, it’s under $18,417.

It is important to note that the $18,417 amount also includes the insurance company’s claim expenses. That’s why I said that the average car accident payout is less than $18,417.

Also, the $18,417 amount does not include car accidents in Massachusetts and No-Fault states. Thus, the $18,417 average settlement amount might not apply to a state like Florida (that has no-fault auto insurance laws).

In a state like Florida that has no-fault insurance laws, the average settlement is likely much less than $18,417. This is because no-fault insurance results in you having much lower out of pocket medical bills.

All things equal, less out of pocket medical bills means a smaller car accident injury settlement amount.

And the $18,417 average settlement amount is for private passenger cars. It doesn’t apply to business vehicles.

Watch this video about how much money you may get for your car accident settlement:

Now:

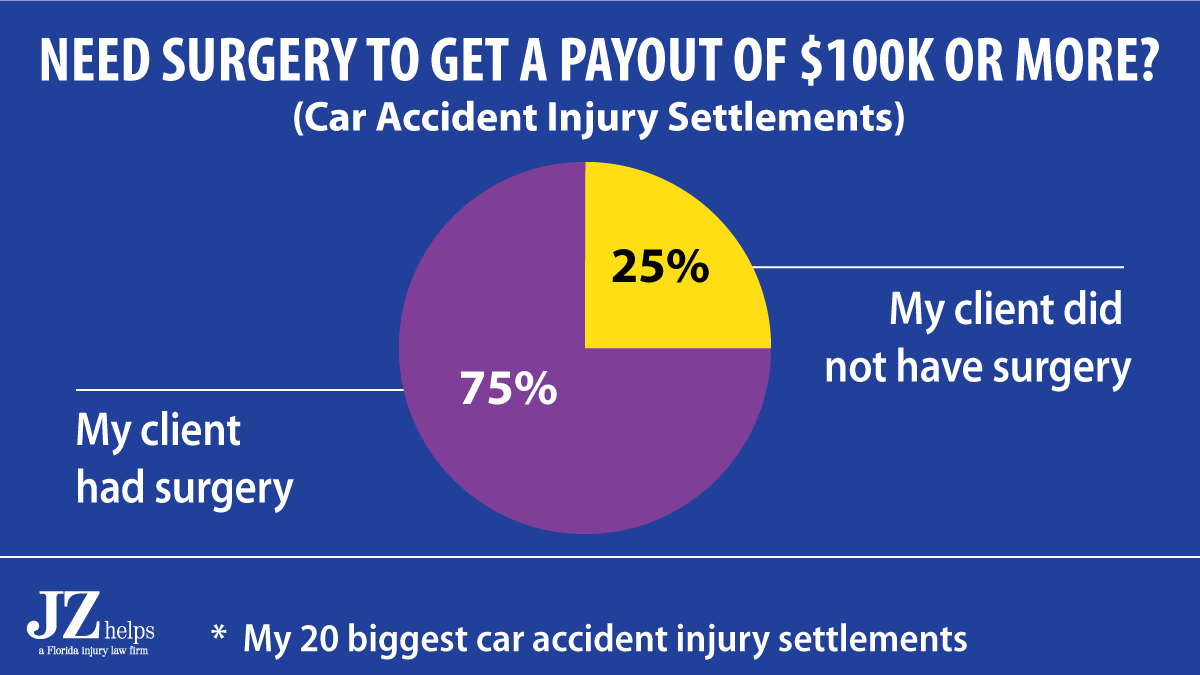

I looked at my 20 biggest car accidents and here is what I found:

75% of my clients who had surgery got a settlement for $100,000 or more.

Take a look:

25% of my clients in those cases were able to get a payout of $100,000 or more without having surgery.

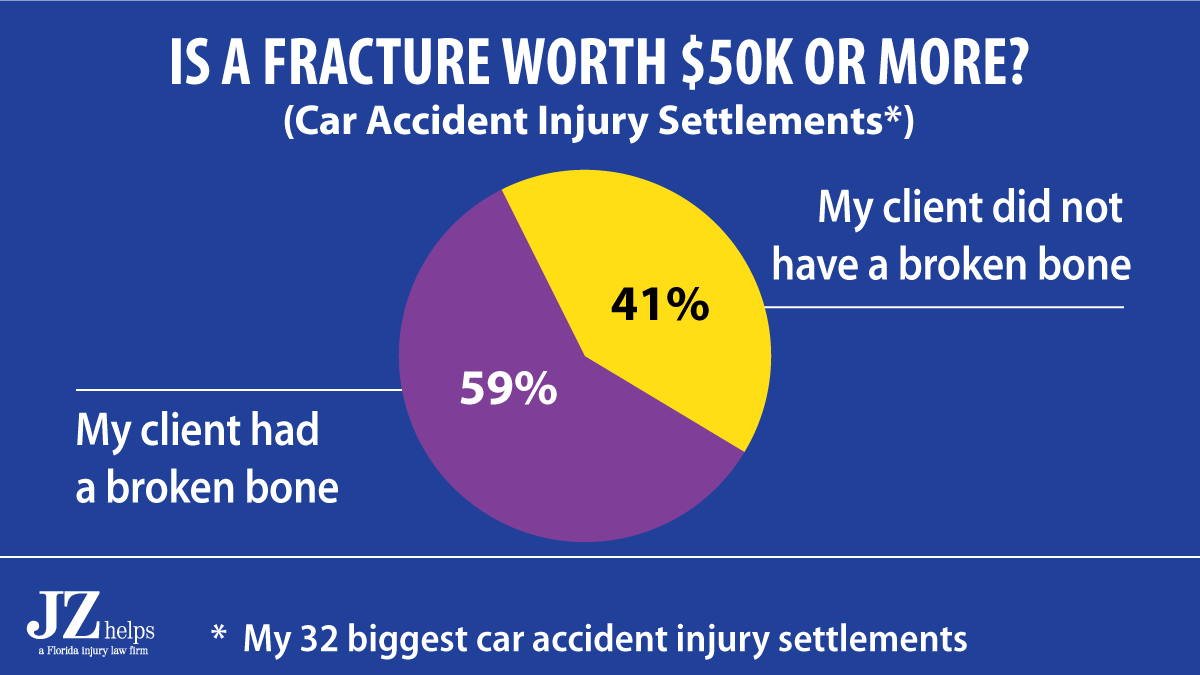

Here is another interesting piece of information:

In my biggest 32 car accident injury settlement amounts that were for $50,000 and more, 59% of my clients had a fracture.

In 41% of those cases, my client did not have a broken bone.

As promised, here are some of my car accident settlements.

I have not listed my motorcycle accident settlements below.

$350K Car Accident Settlement in 2021 (South Florida)

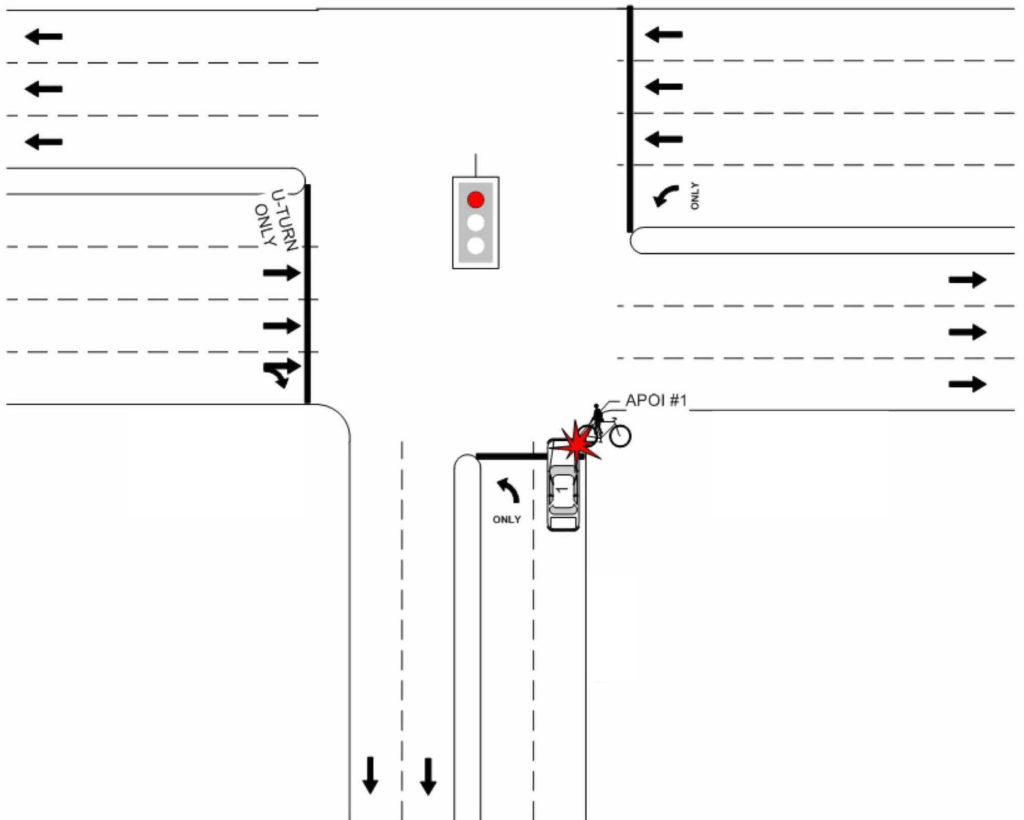

In 2020, Sam (not real name) was riding his bike in South Florida.

At the same time, Joe (not real name) was in his car heading north.

Joe was turning to go Eastbound.

While Sam rode his bike westbound in the crosswalk crossing, Joe accidentally hit him with his car.

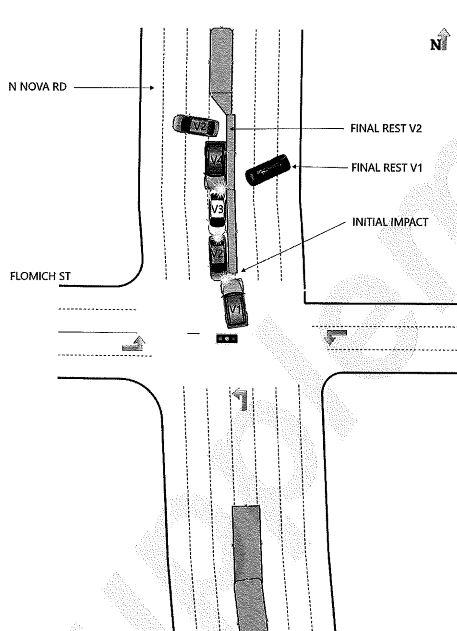

You can see a crash diagram below:

As a result of the car hitting him, Sam broke 3 bones in his ankle.

You can see one of his broken lower leg bones here:

At the hospital, a doctor drilled screws into a plate in Sam’s leg.

You can see a photo that the doctor took during the surgery:

After he left the hospital, Sam searched for a South Florida lawyer who had settled many car accident cases. He found me. Sam called my office and I gave him a free consultation. Shortly after we spoke, Sam hired me.

GEICO insured the driver (and owner) of the car that hit Sam. Due to pain and swelling in his ankle, the doctor removed the plate and screws.

Sam had Medicaid, a Medicaid HMO and another temporary assistance program. They paid under $6,400 to the hospital and his doctors. And the hospitals and doctors adjusted (reduced) the bills to zero. In other words, Sam did not owe the hospital or doctors any money.

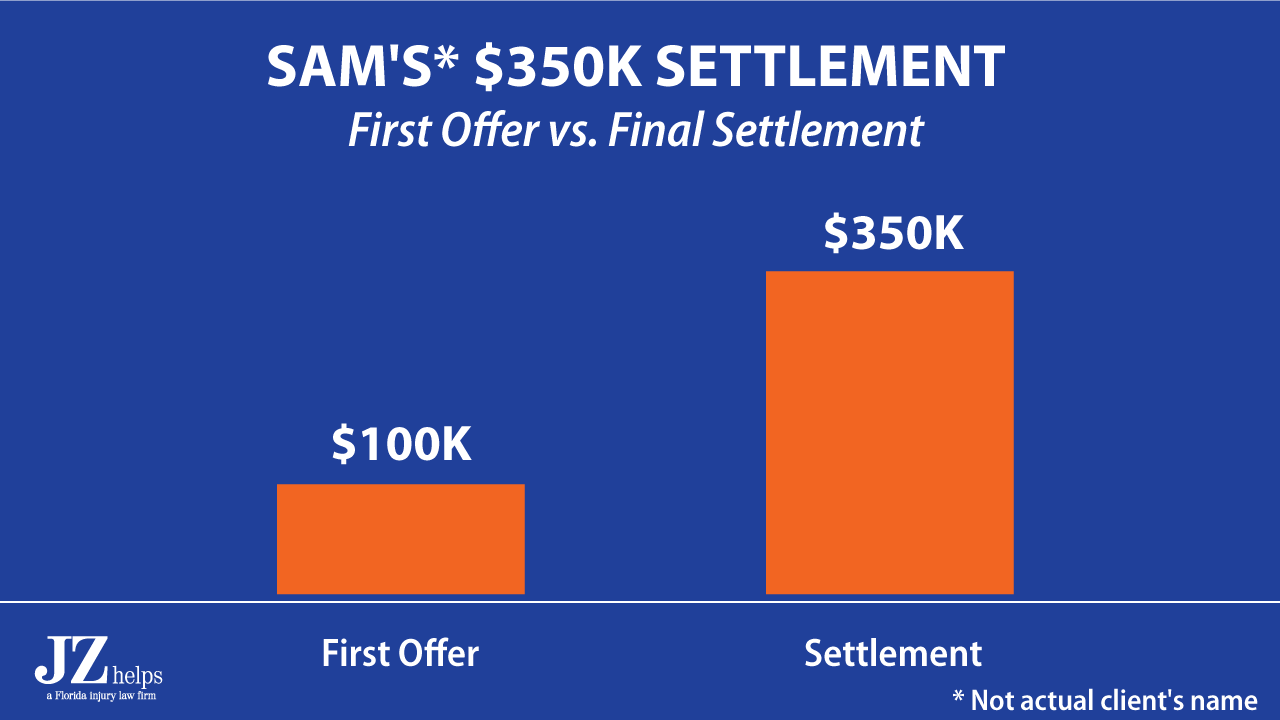

The car’s insurance company offered $100,000 to settle Sam’s car accident injury claim. The defense lawyer said that the offer was fair. We told Sam to reject it.

We then battled with GEICO for four months.

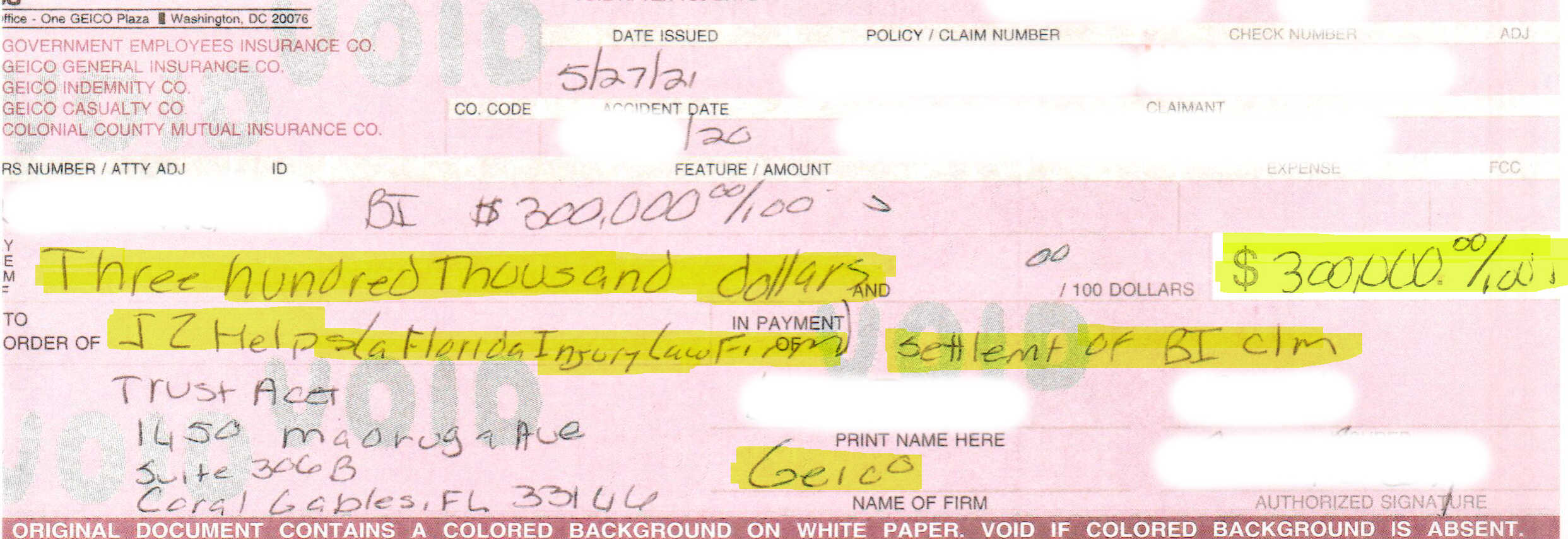

In 2021, GEICO paid us $350,000 to settle Sam’s personal injury claim.

This chart shows a comparison between the first offer and the settlement.

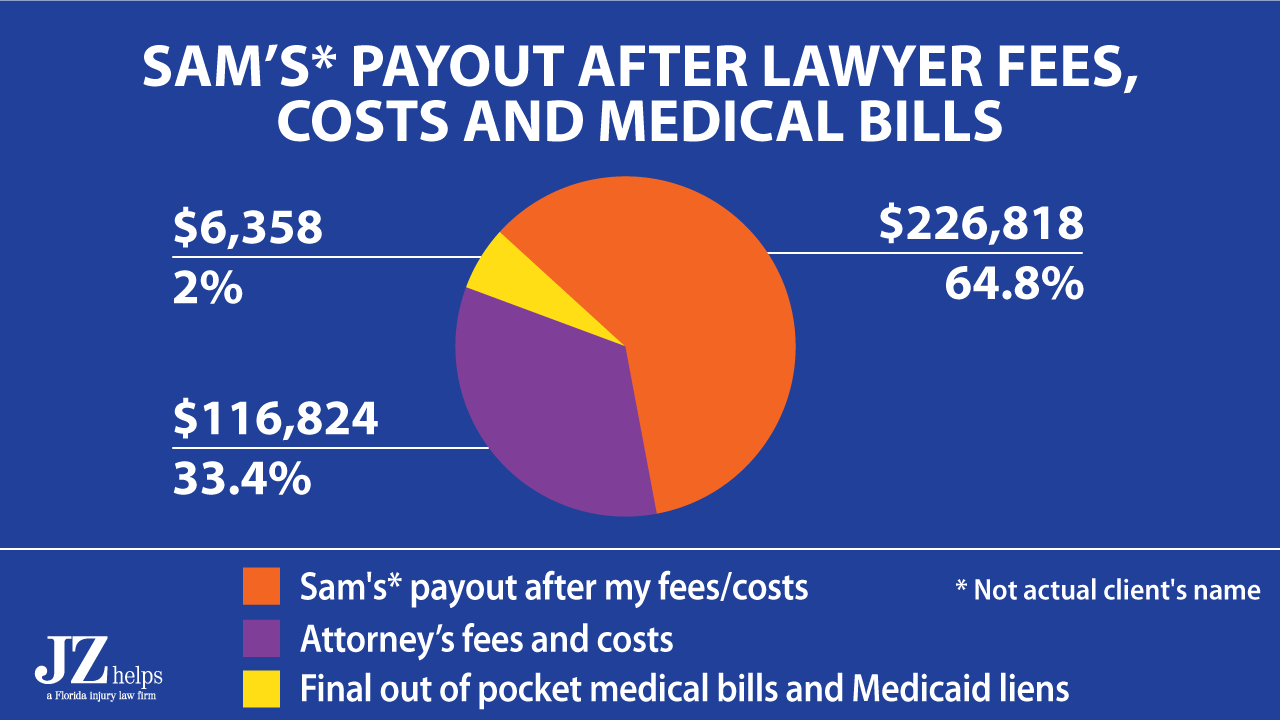

After my attorney fees and costs, and paying back the Medicaid liens, Sam got $226,818 of the settlement in his pocket.

Take a look:

You can see the $300,000 car accident injury settlement check below (redacted):

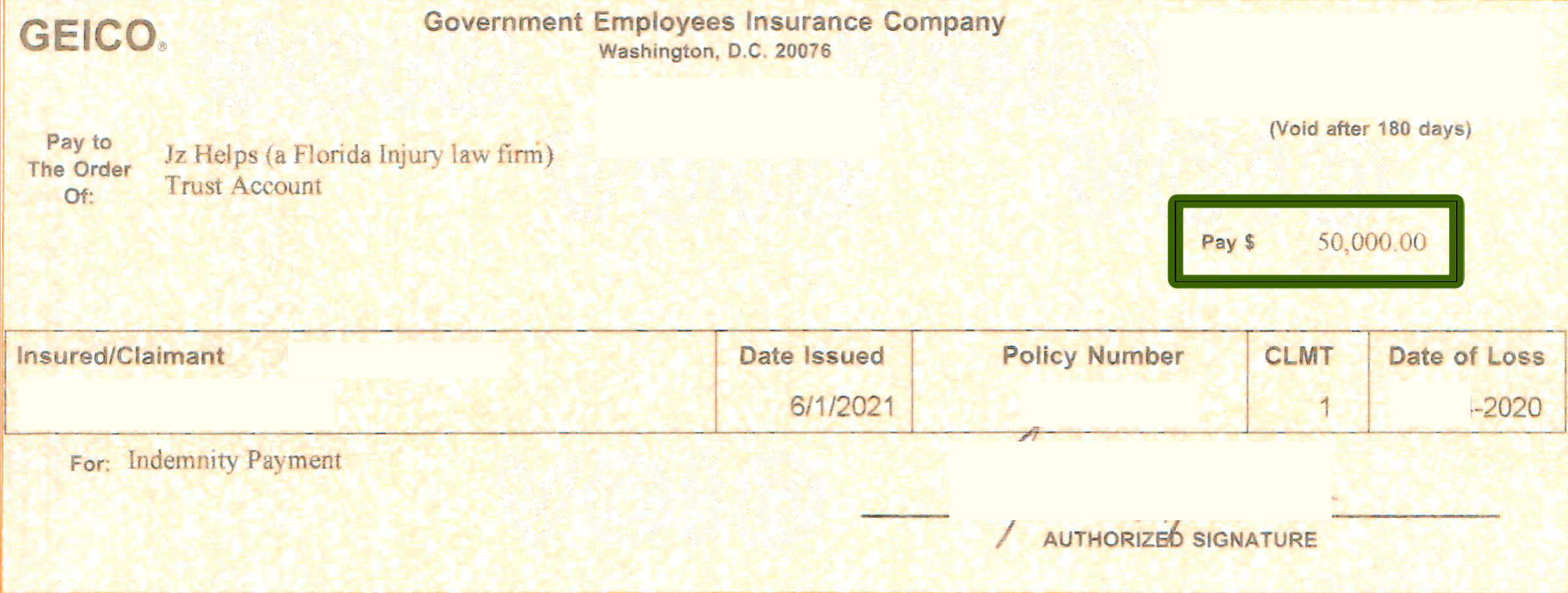

They also sent us a $50,000 settlement check from the driver’s personal umbrella insurance policy.

You can see the redacted settlement check below:

Sam is thrilled with the settlement.

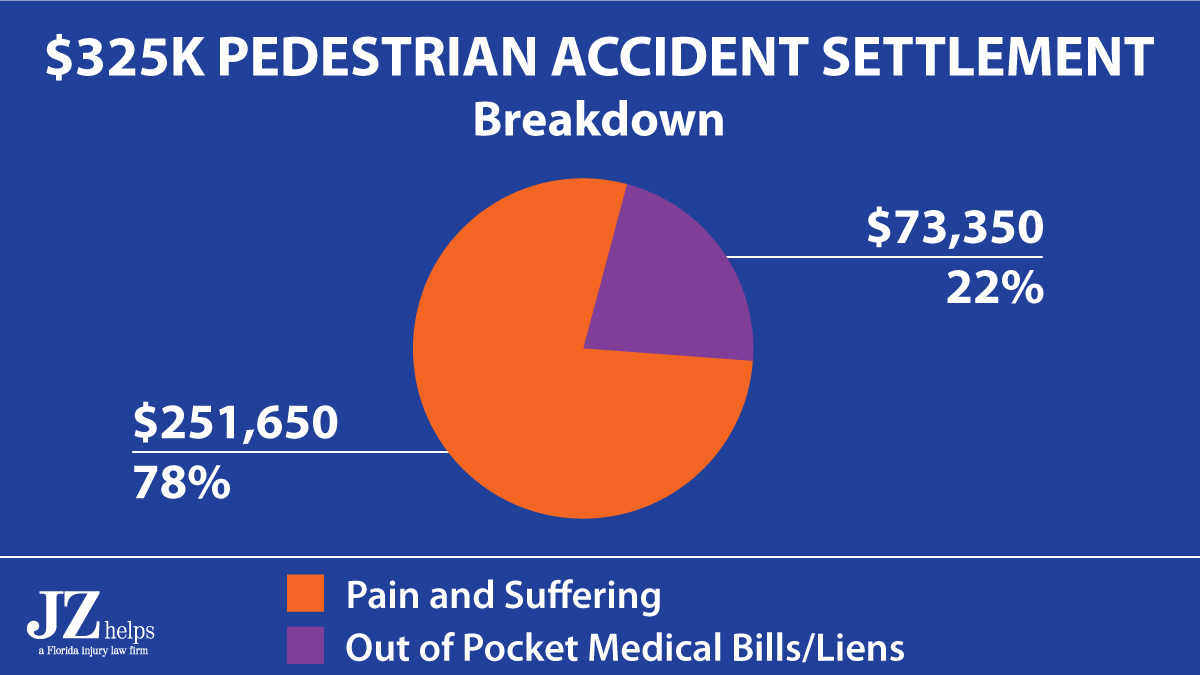

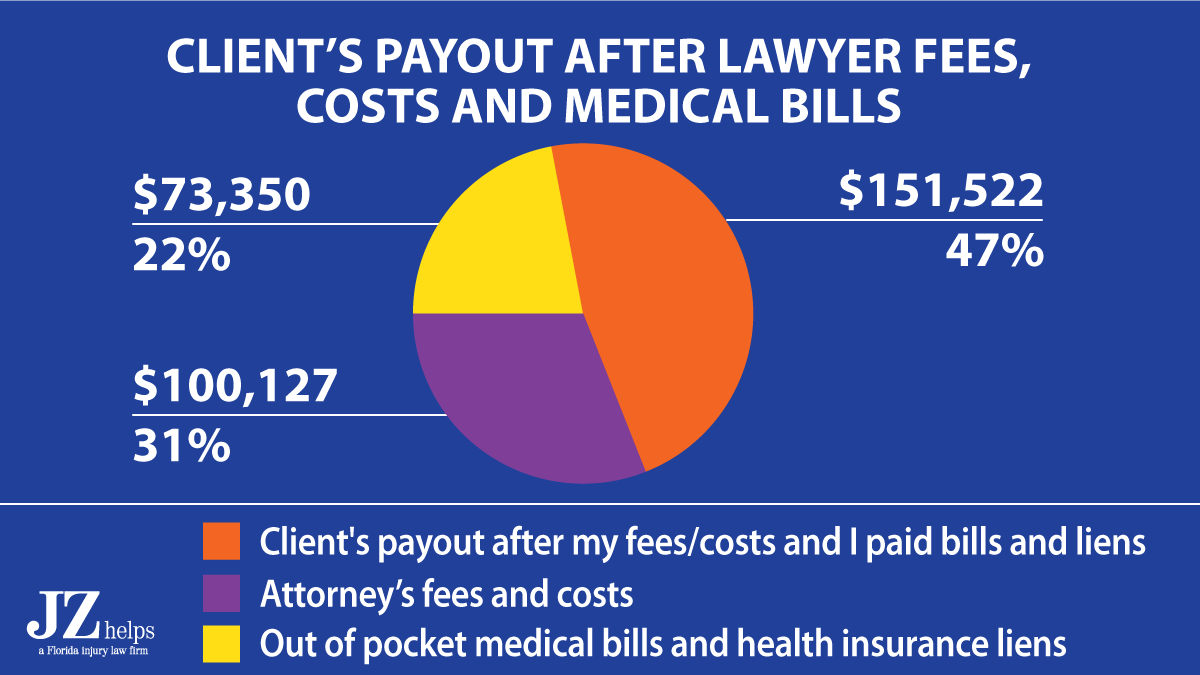

$325K Settlement (Car Hit a Pedestrian)

A European man was visiting Miami, Florida. While in Coconut Grove, a car hit him. As a result of the impact, the pedestrian broke his leg.

An ambulance rushed him to the hospital. There, he had surgery to his fix his tibia (lower leg bone). The pedestrian flew back to Europe. He chose to get a free consultation from me by filling out my simple contact form. We spoke on Skype.

He wanted to know if I could get him compensation. After we spoke, he hired me as his lawyer.

Philadelphia Insurance insured the driver who hit my client. He was driving a rental car for the US government.

Philadelphia Insurance Company paid $100,000 of this settlement.

When he rented his car, he purchased liability insurance. This included $100,000 in uninsured motorist coverage. As you’ll see, this turned out to be a fantastic decision. Ace Insurance Company was our client’s UM insurer.

Ace paid $100,000 as well. We also sued the United States. They paid an additional $125,000. In sum, we settled the entire case for $325,000.

Like most car accident cases with serious injury and plenty of insurance coverage, most of the settlement was for pain and suffering.

Also, like most car accident settlements, my client got the most of the settlement money after my lawyer fees, costs and paying back his health insurance company.

Here, my client got a check for $151,522 after my fees and me paying back his health insurance company for the bills that it paid.

As I mentioned earlier, many factors affect the settlement value of a car accident case. Here my client had surgery. Surgery greatly increases the size of a car accident settlement.

Just look at some of my largest auto accident settlements below. In most of them, you’ll note that my client had surgery.

$300,000 Car Accident Injury Settlement

Ryan was driving a rental car in Clearwater, Pinellas County, Florida. He was in Florida for business purposes.

Another driver crashed into Ryan’s car.

You can see the damage to Ryan’s rental car.

Below, you can see the damage to the other driver’s car:

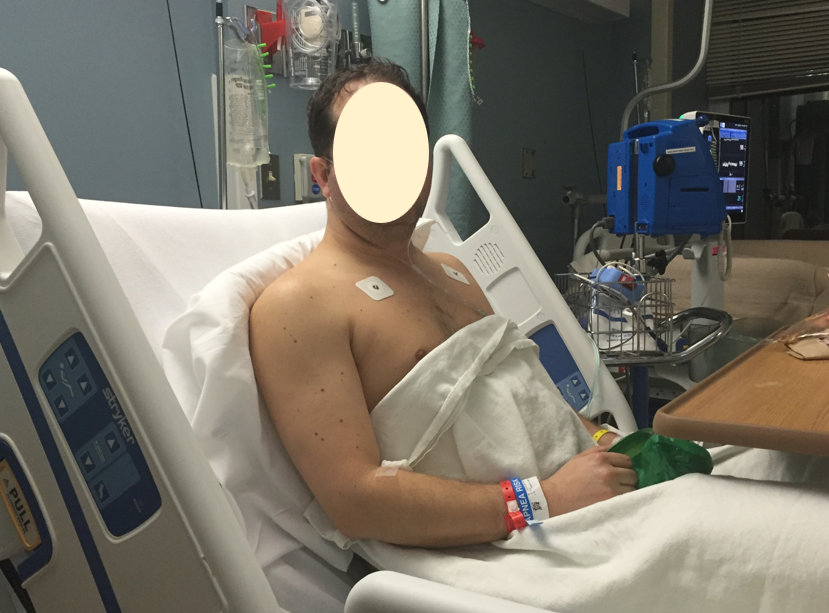

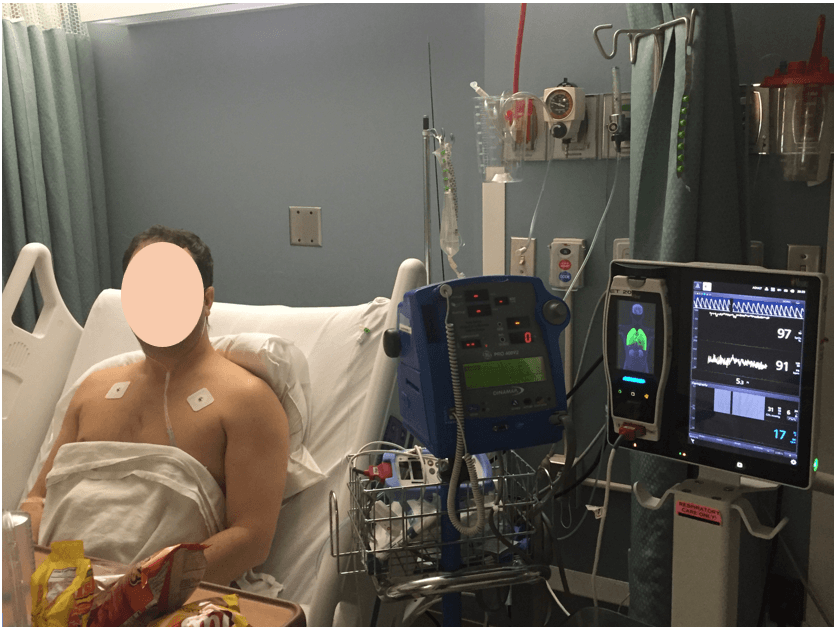

At the hospital, someone took a photo Ryan. Check it out:

Here is another image that focuses more on the equipment that was used to monitor his vitals:

He had a broken leg (tibial plateau). While in the hospital, Ryan searched for car accident lawyers. He found our website and decided to get a free consultation with me.

Let Me Fight to Get You a Fair Settlement

After we spoke, he hired me. At the hospital, doctors performed surgery on his leg.

In particular, they put a plate and screws into his leg.

After surgery, the doctor put a cast on his leg.

When he left the hospital, he could not walk. He was wheeled out of the hospital.

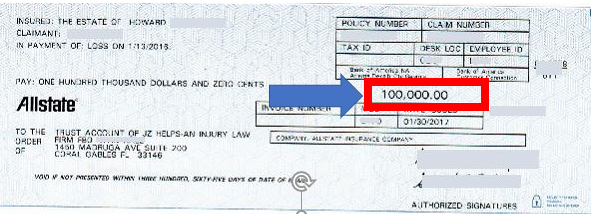

Allstate insured the careless driver’s car.

However, he only had $10,000 in bodily injury liability (BIL) coverage.

Within 8 days of the car accident, Allstate sent me a check for the $100,000 BIL limits.

There is no guarantee that the car insurance company for the at fault driver will send you a $100,000 settlement check within 8 days of a car accident.

However, here is my video about when you’re most likely to get a $100,000 settlement check within 8 days or less after a car accident:

I did not want to deposit the $100,000 check.

Why not?

Since my client had Georgia uninsured motorist insurance, we needed to keep the at fault driver in the case.

In order for Ryan to go to orthopedic visits and physical therapy, a medical transport van would come to his home.

There, someone would load him into a van while he was in a wheelchair.

Ultimately, Ryan made a good recovery.

I settled with Allstate for the $100,000 BIL limits.

Travelers was his uninsured motorist insurer. They paid me $200,000 to settle.

Here is the Travelers Insurance settlement check:

In total, the car accident injury settlement amount was $300,000. This is about 20 times more than the average settlement for a car accident.

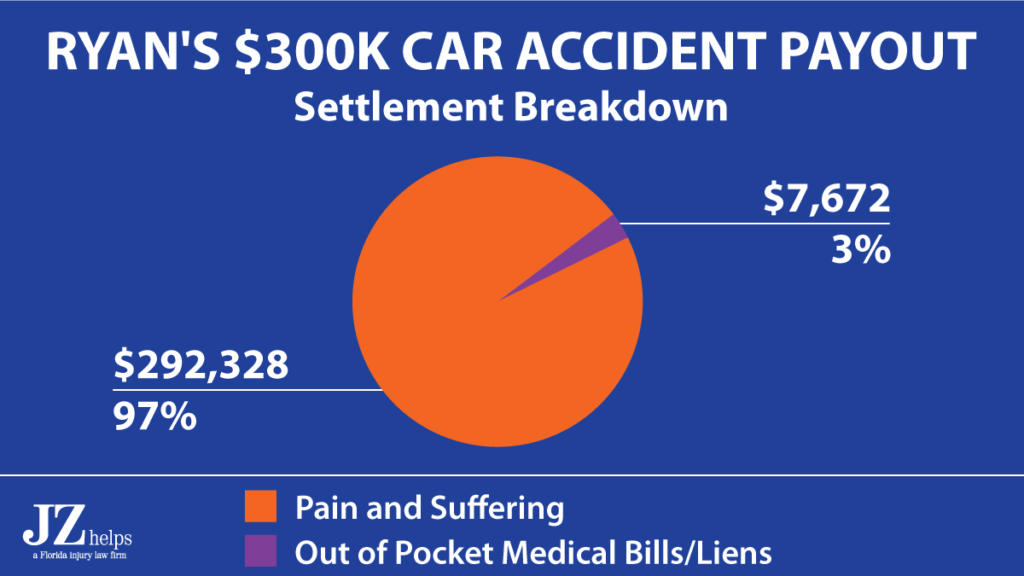

When the insurance companies made the combined $300,000 offer, I estimate that about 97% of the settlement was for pain and suffering:

Workers’ comp paid around $85,000 to Ryan’s doctors. And they wanted that money back from the settlement.

The good news?

Since Ryan had a lawyer, they had to reduce this amount by my lawyers fees and costs.

This resulted in an instant savings of over $28,000 to Ryan! Again, he only got that savings because he had attorney.

If he did not have a lawyer, the workers’ compensation insurer would not have had to reduce its payback claim by pro-rata lawyer fees and costs.

I didn’t stop there.

Next, I fought to reduce the $85,000 workers comp lien. I even used the rental car’s PIP to further cut down the lien. In the end, we only had to pay back workers’ comp around $3,000.

If Ryan did not have an attorney in this car accident case, he would have had to pay the workers compensation company back over $28,000 more. And probably much more than that. This is because workers comp would not have reduced their payback claim by my pro-rata attorney’s fees and costs.

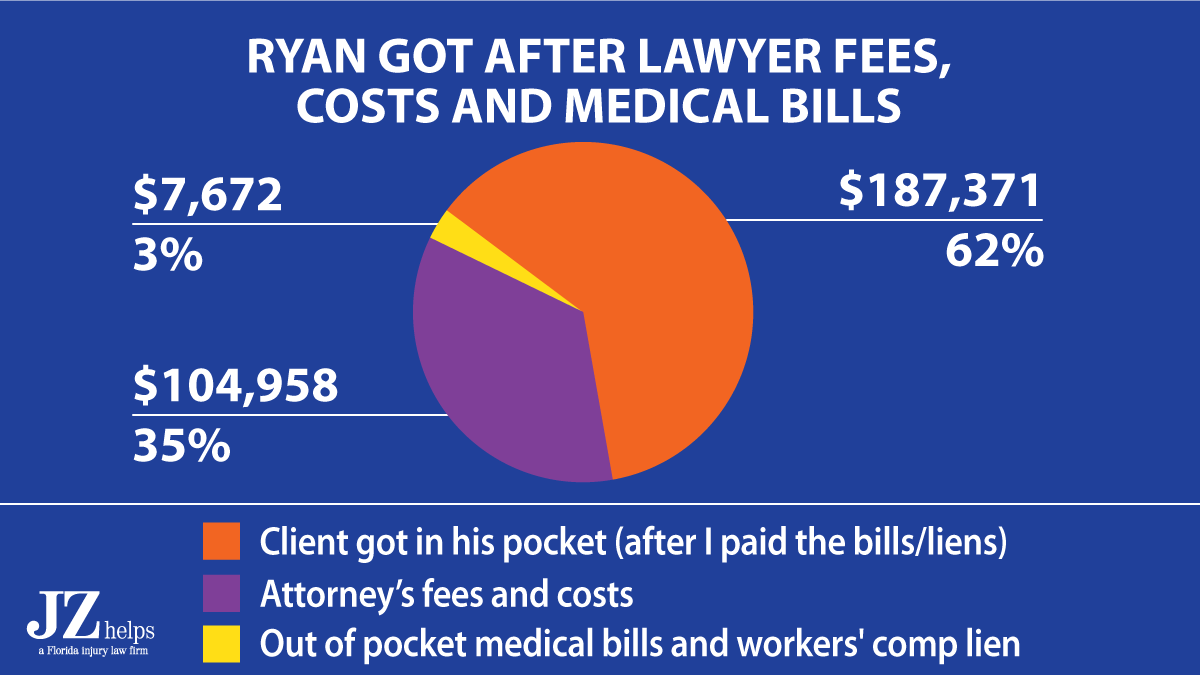

After my attorneys fees, costs, and paying the workers’ compensation lien and medical bills, Ryan got $187,371 in his pocket.

This chart shows the breakdown:

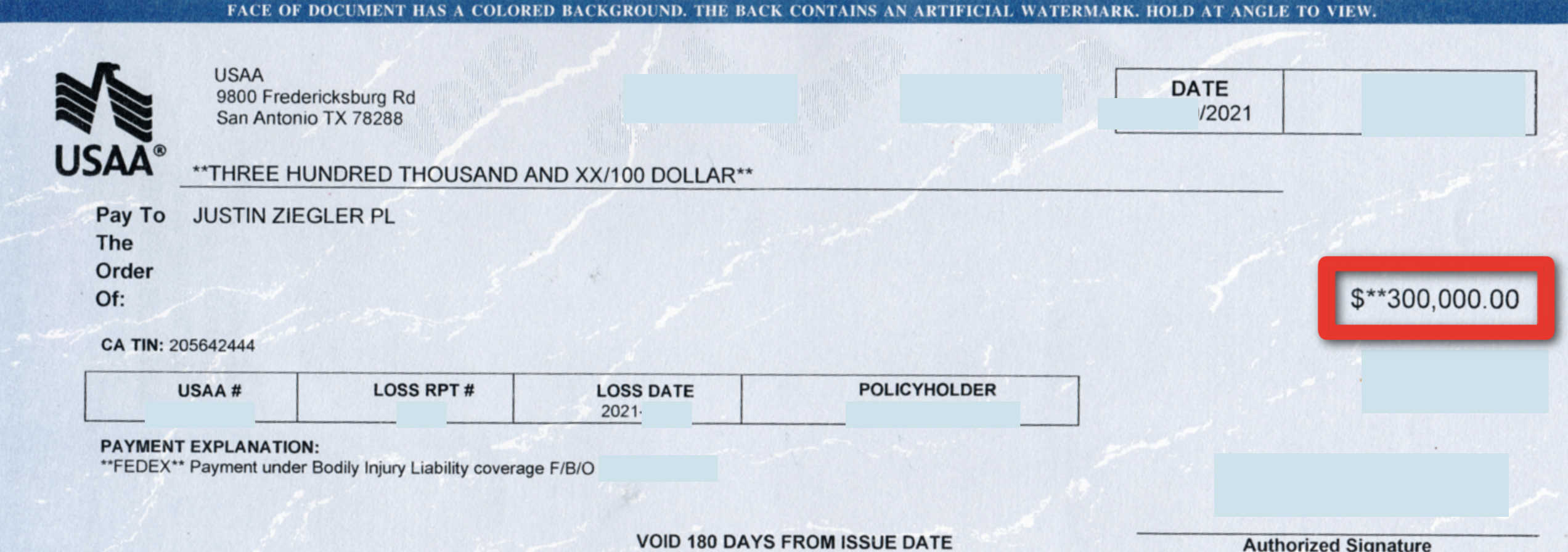

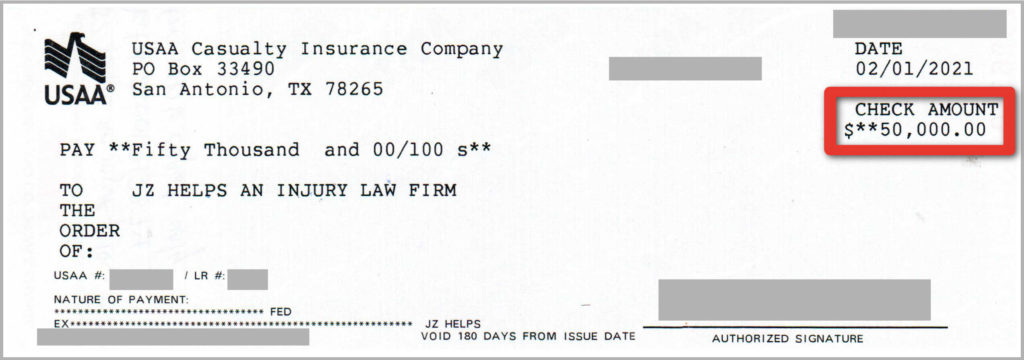

$300,000 Car Accident Injury Settlement (2021)

Jose (not real name) was riding a motorcycle in South Florida.

A driver crashed into Jose and he got injured.

Jose got a Free Consultation with me (attorney Justin Ziegler). We spoke and he quickly hired me.

I jumped into action on his case.

USAA insured the car with a $300,000 bodily injury liability insurance limit. But they did not pay us immediately. USAA played hardball.

Within two months after this accident, we settled with USAA for $300,000.

Here is the settlement check (redacted):

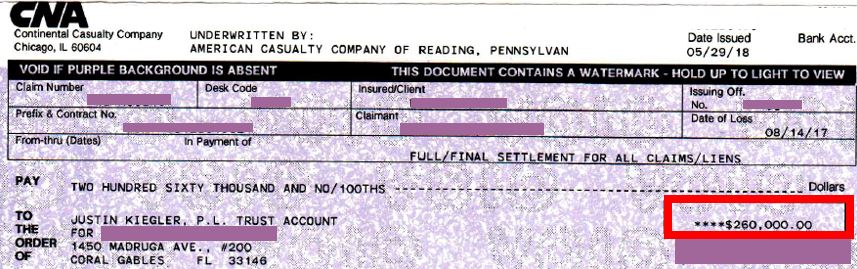

$260K Settlement for Uber Car Accident (Miami)

Ray was driving for Uber in Miami. While heading straight on the road, a van made a left hand turn into Ray. They crashed.

Shortly after the accident, his girlfriend drove him to the hospital. While there, he called my office to get a free consultation to see if I could represent him. He was looking for an Uber accident lawyer. After we spoke, he hired me.

I drove to Coral Gables hospital. As you can see, I took a photo of Ray.

Notice that the photo above is great quality. Be sure to take high resolution photos. Make sure that the photos are large, high-quality images that are at least 1,200 px wide.

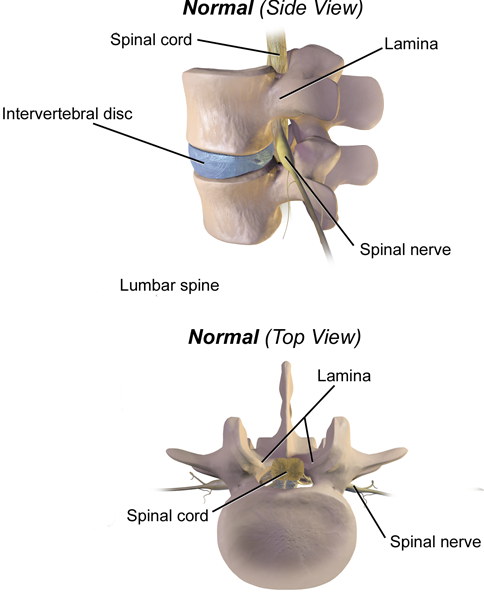

The Uber driver claimed that the accident caused a fracture to one of the lamina in his spine. You can see where the lamina is in the lumbar (lower back) spine.

He did not have surgery. We also claimed that the impact caused or aggravated his disc protrusions (herniated discs).

CNA insured the other driver’s van. The other driver was working at the time of the accident.

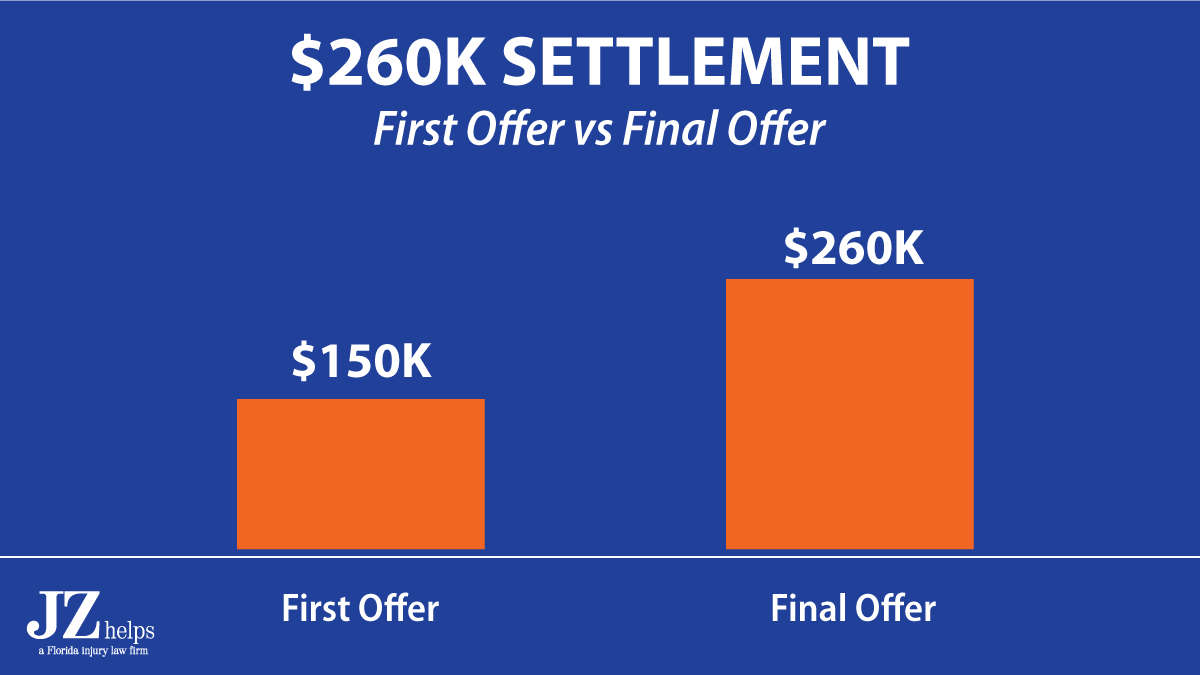

CNA’s first offer was $150,000.

In May 2018, CNA paid me $260,000 to settle the Uber driver’s personal injury claim.

This image shows the comparison between CNA’s first offer and the settlement:

This is about 17 times greater than the average settlement for a car accident.

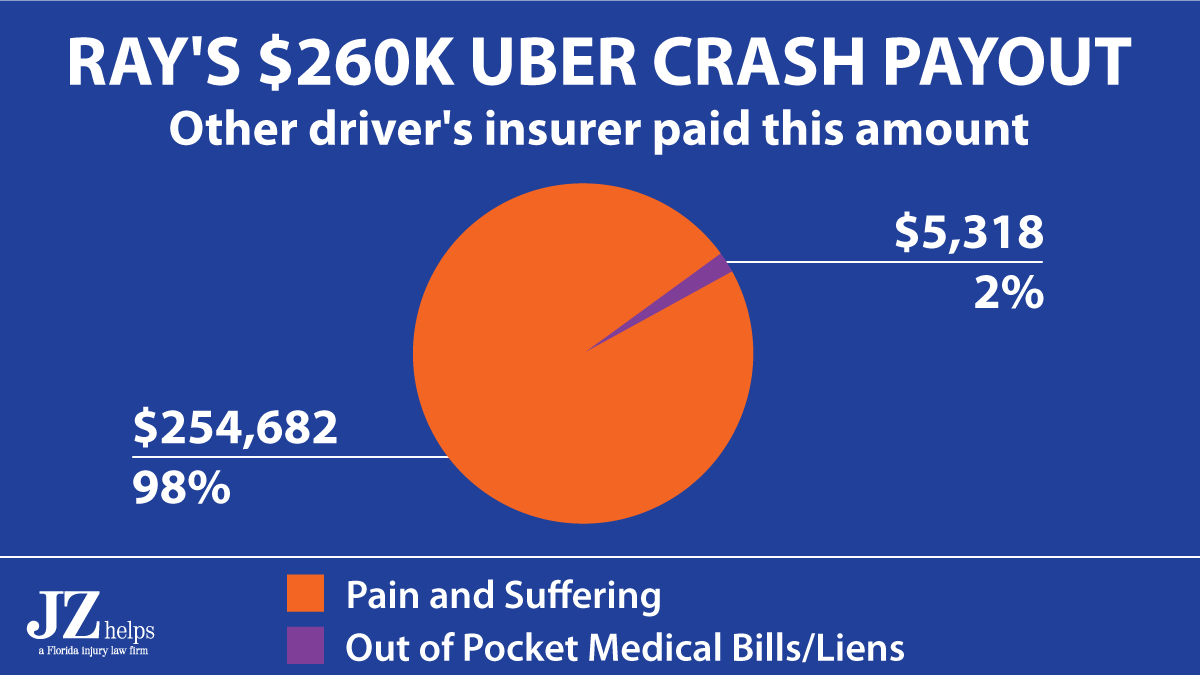

The other driver was at fault. Most of the settlement was for pain and suffering.

The settlement also covered my client’s medical bills.

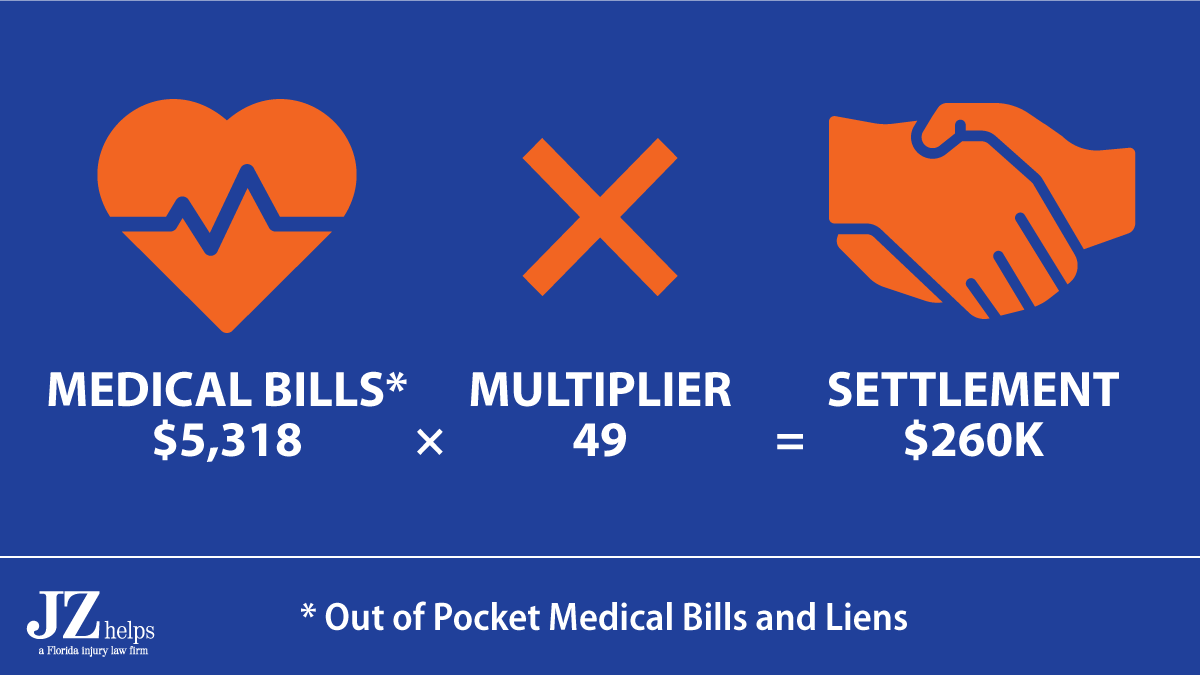

The $260,000 settlement was about 49 times Ray’s out of pocket medical bills and Medicaid lien.

Medicaid paid Ray’s big hospital bill.

Watch this video about his $260K settlement:

$210,000 Settlement for Shoulder Injury (Truck Accident)

My client was a 57-year-old truck driver. While driving a big rig, another tractor trailer crashed into the rear of his truck. A highway patrol officer arrived at the scene. My client told him that he was not injured.

At the scene, my client took a photo of the damage under his truck. Check it out:

This photo was important because it shows that metal was bent underneath his truck. In other words, this picture shows that this was a hard impact. Thus, the hit was forceful enough to cause an injury.

My client was diagnosed with a shoulder (labrum) tear. A few months after the collision, he had shoulder surgery. He contacted me for a free consultation to see if I could represent him.

Let Me Fight to Get You a Fair Settlement

At that time, he had not received an settlement offer from the other truck driver’s insurance company. We met at my office and he hired me on the spot.

Travelers Insurance provided liability insurance coverage for the other driver’s truck.

Progressive was my client’s uninsured motorist insurer.

In total, Progressive and Travelers paid me $210,000 to settle the case. This is about 14 times greater than the average settlement for a car accident.

Most of the settlement was for my client’s pain and suffering.

$200,000 Car Accident Settlement (broken wrist)

Our client was driving her car when she was hit (T-boned) by a car at an intersection. An ambulance took her to the hospital. She was diagnosed with a wrist fracture. She had surgery for her broken wrist. Doctors put a plate and screws in her non-dominant hand.

She had back pain (bulging disc) and neck pain (2 herniated discs). After her wrist surgery, she had a scar.

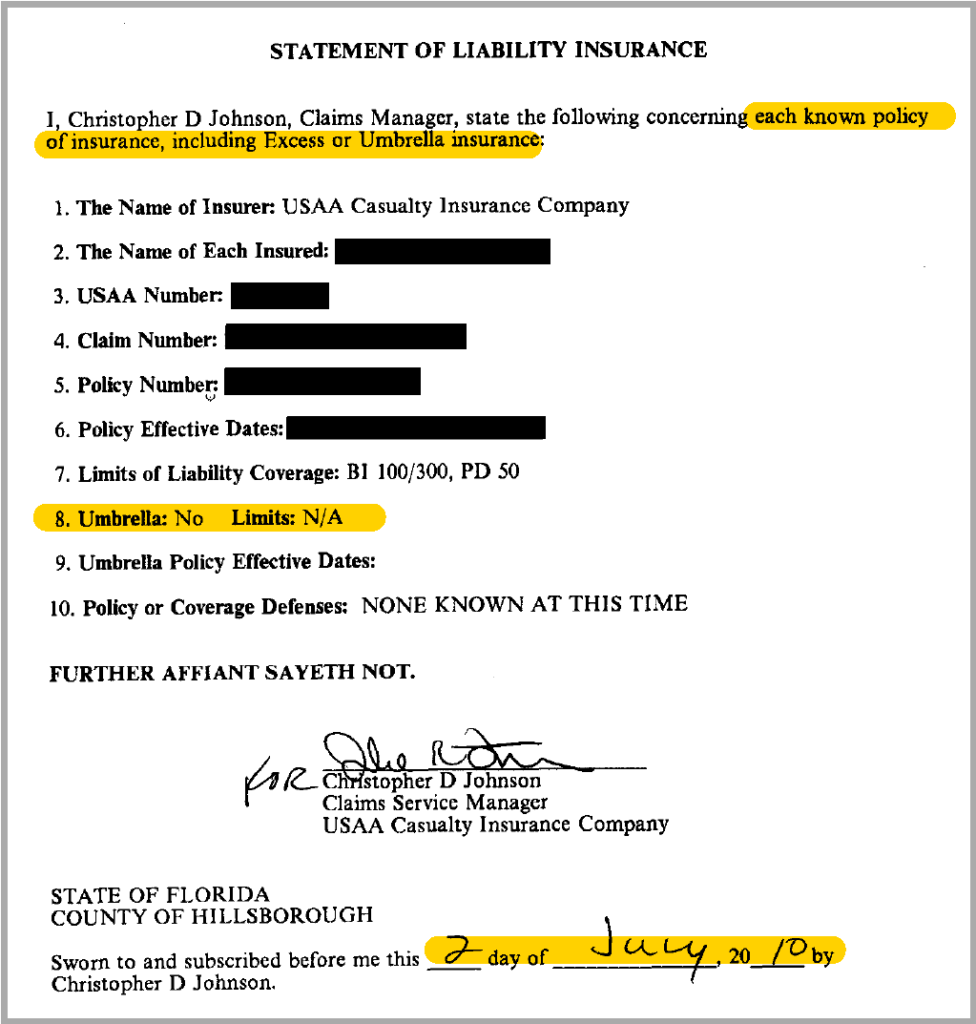

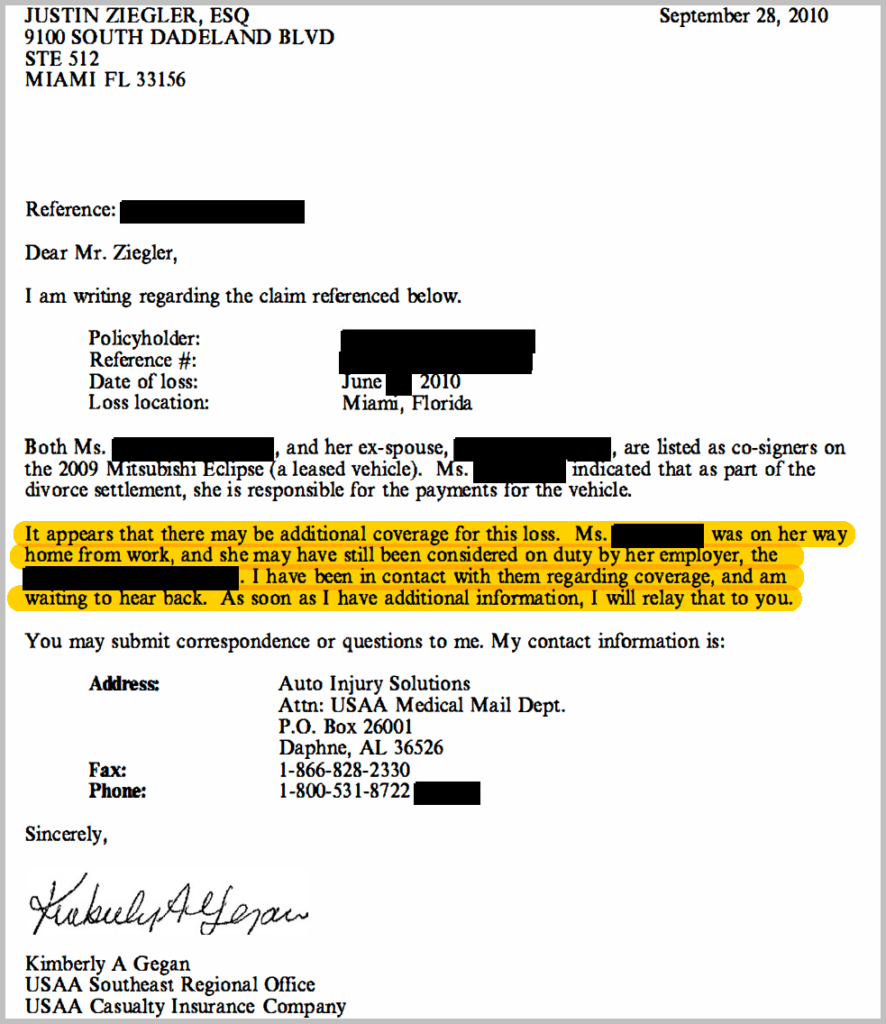

The at-fault car was insured with USAA and Old Dominion Insurance (Main Street America Group). USAA told us that it was only aware of its $100,000 bodily injury (BI) insurance policy.

I asked the at fault driver to complete a financial affidavit that also asked them if she was working at the time of the accident. It was only then that USAA told me that the at fault driver was working at the time of the accident.

Fortunately, her employer insured her with a $1 million insurance policy.

Within four months of the accident, USAA offered me the $100,000 to settle.

Old Dominion paid $100K to settle. The total settlement was for $200,000. This is about 13 times the average car accident settlement.

$170K Auto Accident Settlement

On June 30, 2018, Zach was in a car accident in Sarasota, Florida. He was in a rental car when the driver hit the car in front of him.

Take a look at the car that Zach was in:

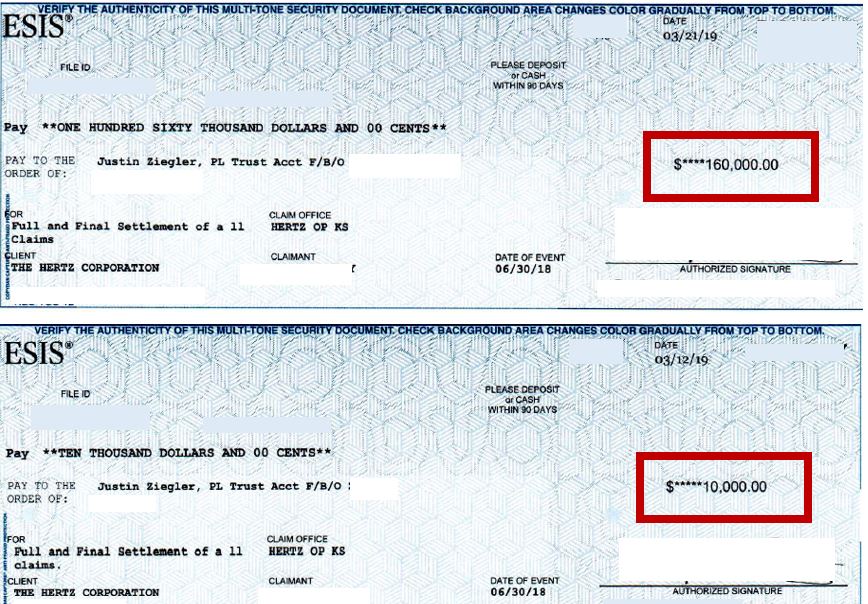

ESIS (Ace American Insurance Company) insured the Hertz rental car.

Paramedics took him to the hospital. As a result of the car accident, he broke his upper arm bone (humerus). At the hospital, someone took a photo of Zach.

He had surgery to his upper arm bone (humerus). ACE/Chubb did not make Zach’s mom a settlement offer for his injuries. His mom said:

I tried for the first couple months to deal with the insurance companies on my own and then realized I needed professional help.

Part of Maureen’s quote on our Facebook page reviews.

Zach’s mom (Maureen) got a free consultation with me.

Let Me Fight to Get You a Fair Settlement

A short time after we spoke, she hired me.

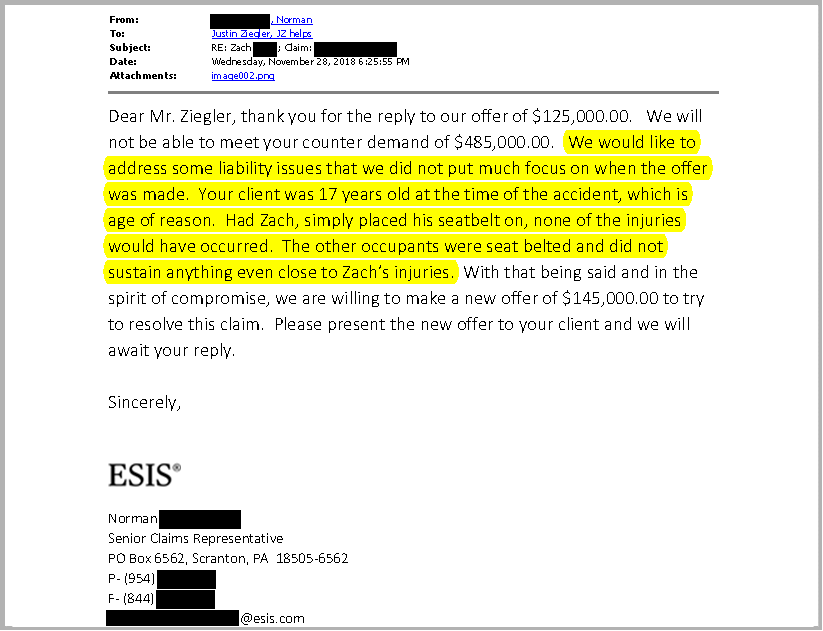

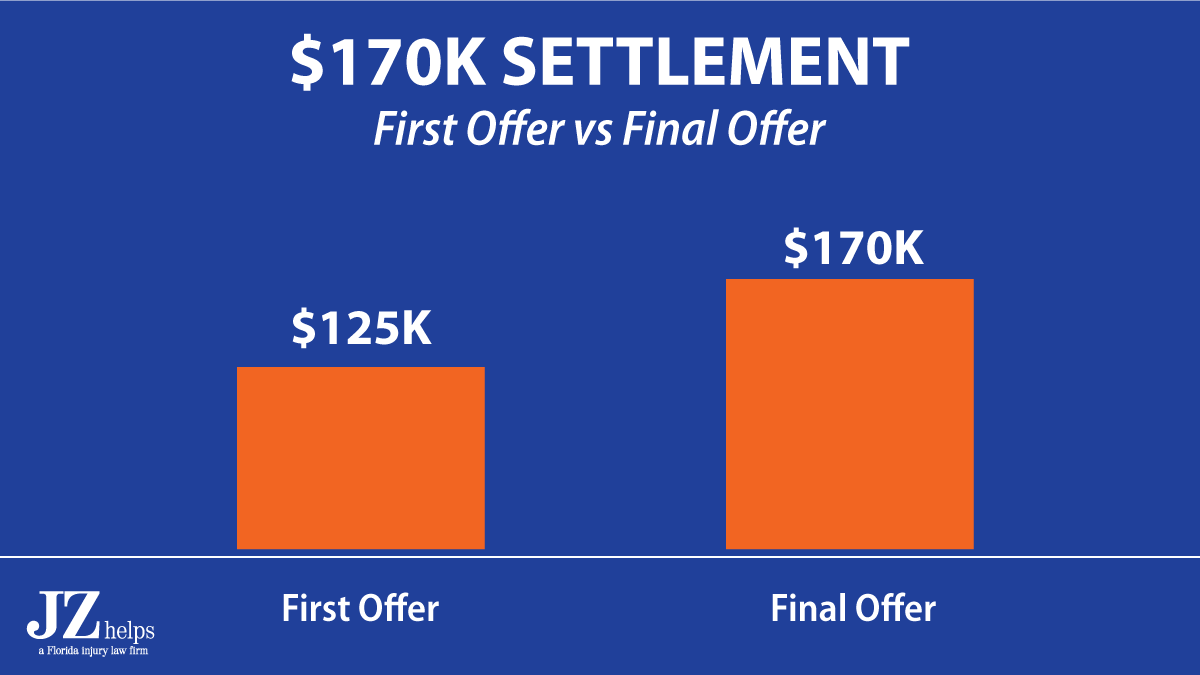

ESIS assigned bodily injury adjuster Norman Schwartzman to the claim. Norman’s first offer to settle Zach’s personal injury case was for $125,000.

He blamed Zach for not wearing a seat belt.

Take a look at the adjuster’s email to me below:

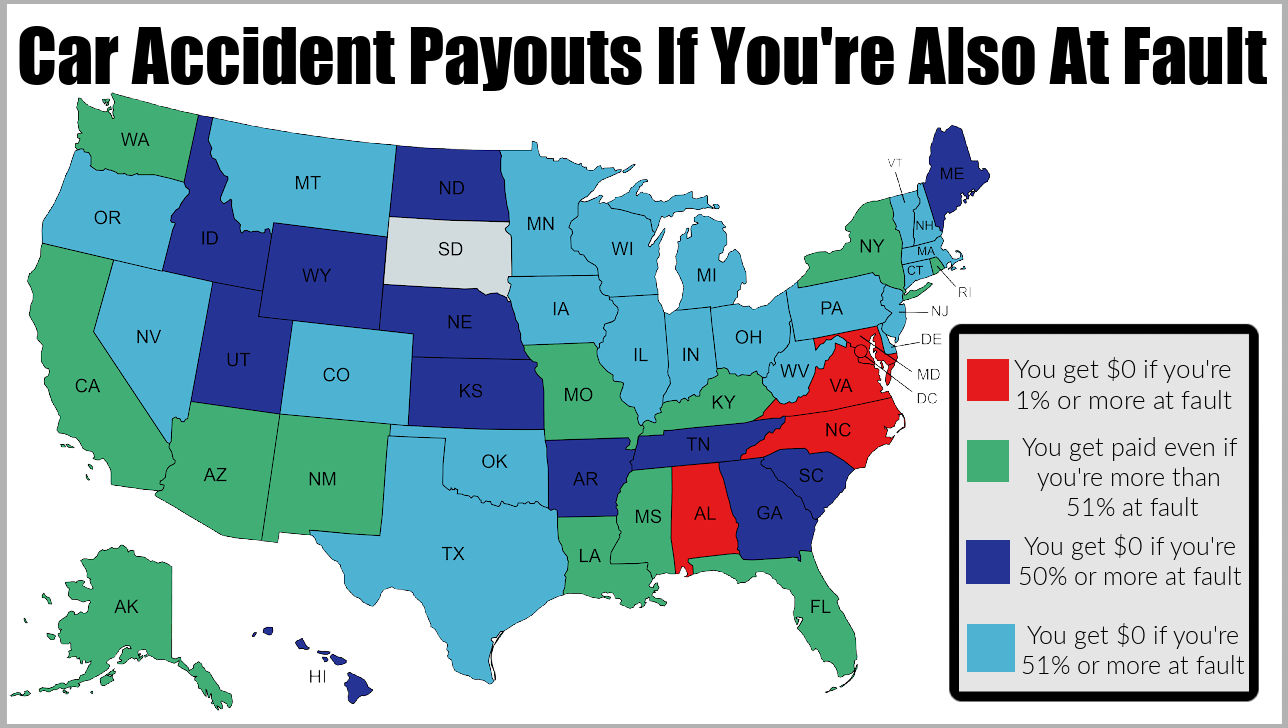

Fortunately, in a Florida car accident, you can still get compensation even if you’re partly at fault for causing your injury.

In fact, Florida is one of several states that allows you to get compensation even if you’re over 51% at fault.

Check it out this map:

However, the value of your case is still decreased by your percentage of fault.

So if the adjuster put 10% to 15% fault on Zach for not wearing a seat belt, then he likely reduced the value of the case by 10% to 15%.

Through hard negotiation, I was able to reach a $170,000 settlement for his case with ESIS.

Here is a comparison of the first offer and the final settlement:

This $170,000 car accident injury settlement is about 11 times greater than the average car accident settlement.

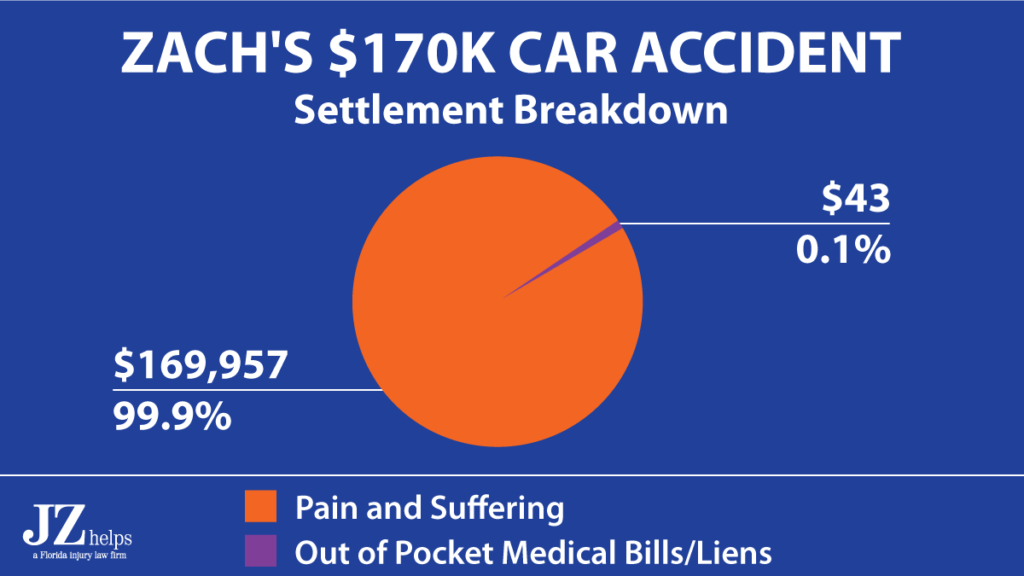

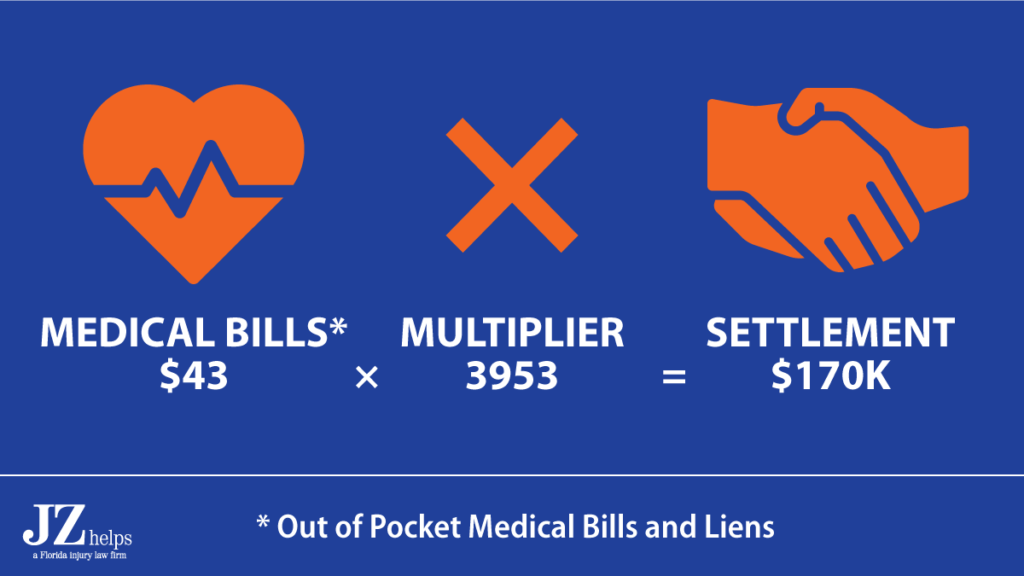

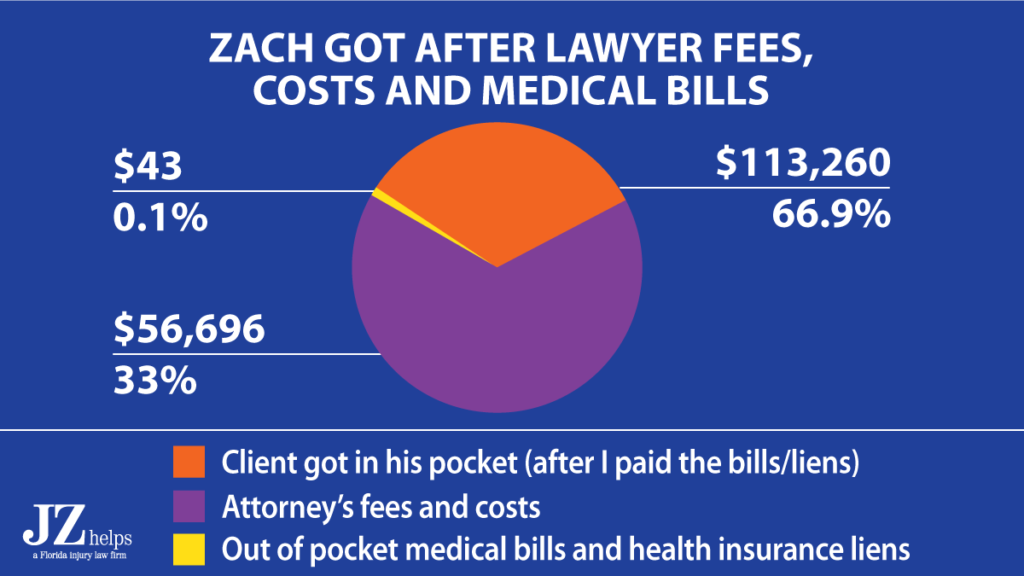

99.9% of the settlement was for Zach’s pain and suffering.

Only $43 of the total settlement was for my client’s final out of pocket medical bills. This is because my client had Medicaid. Thus, the hospital reduced (adjusted) the amount that Zach owed to zero.

Basically, the $170,000 final settlement is about 3,953 times greater than Zach’s final out of pocket medical bills!

Yes, you read that correctly.

You can see the settlement checks below.

After my attorney’s fees, costs and paying Zach’s out of pocket medical bills, I sent Zach a check for $113,260.

The good news?

Zach’s arm healed very well. Currently, he does not have pain in his arm. However, he is left with a long scar from the surgery.

$150K Settlement for Lower Back Injury (Miami Car Accident)

A passenger had a back (lumbar) fusion surgery after another car hit him in Miami, Florida.

$130K Car Accident Injury Settlement

A passenger was in a car that was hit by a uninsured driver in Bonifay, Holmes County, Florida.

Check out the damage to the car that she was in:

Shortly after the accident, she hired me as her lawyer. She injured her shoulder and had rotator cuff surgery. She also had a manipulation under anesthesia.

I made a claim against uninsured motorist (UM) insurance with Nationwide. I settled her uninsured motorist bodily injury claim with Nationwide for $130,000 without a car accident lawsuit.

$135K Car Accident Injury Settlement

A passenger got a $135,000 settlement after another car crashed into the car that she was in. The driver of the other car got a ticket for failure to yield the right of way.

The accident caused our client’s wrist fracture and surgery.

$125K Car Accident Injury Settlement

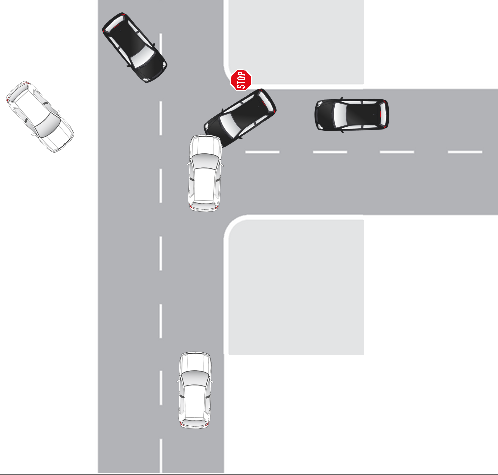

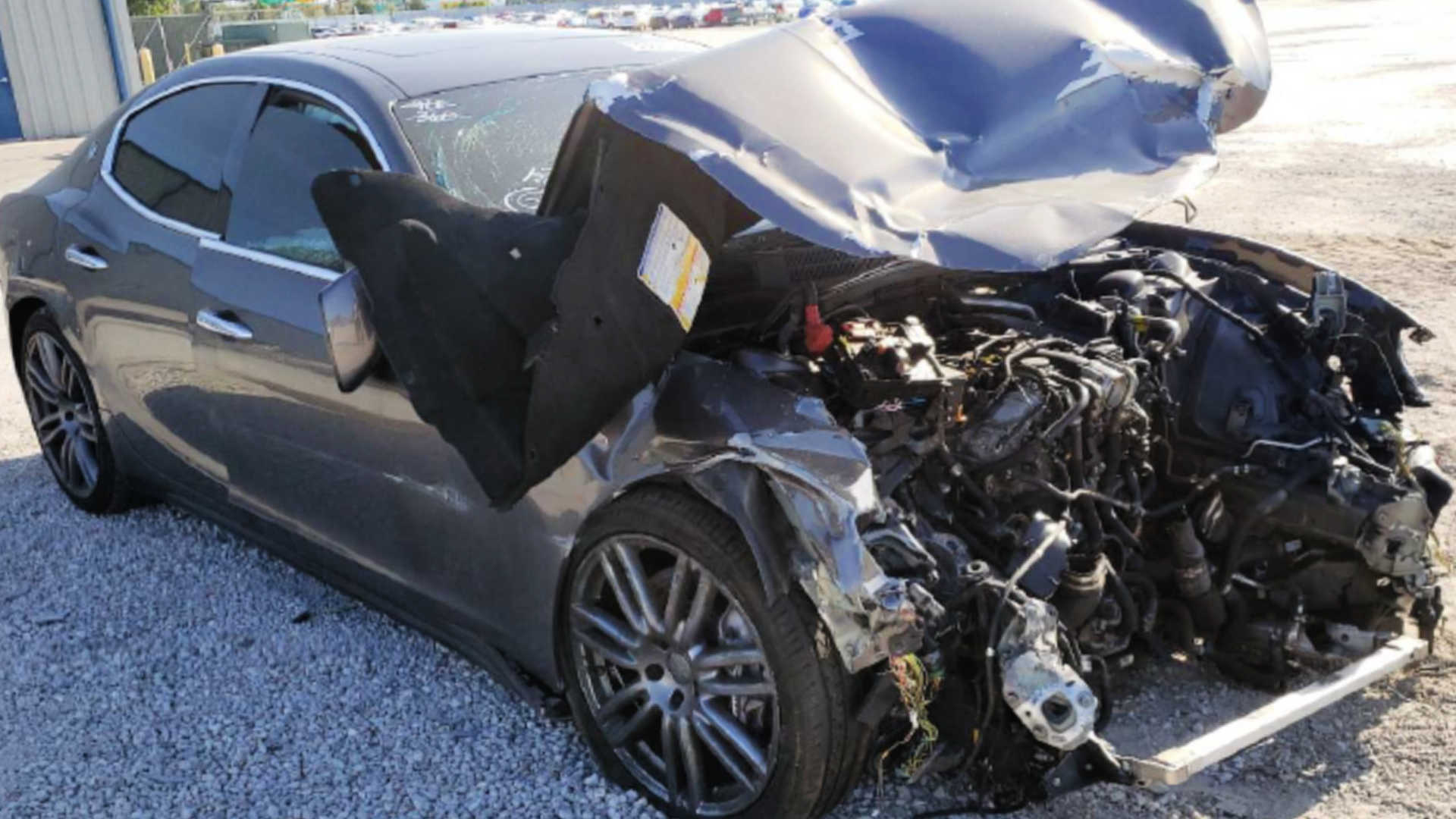

Richie was a police officer. He was driving his police car in Miami, Florida. Another driver failed to yield at a stop sign and “T-boned” him.

Richie’s car sustained big damage in the crash. A tow driver removed it from the scene.

After the accident, his police cruiser looked like this:

The airbag deployed in his car.

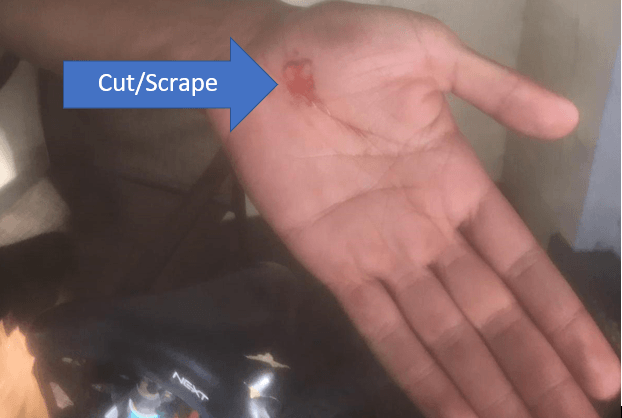

As you can see, it cut his head:

However, he did not need stitches.

As a result of the crash, he broke a bone in his hand (5th metacarpal). To be exact, he fractured his fifth metacarpal. This is what the 5th metacarpal looks like:

A doctor operated on his hand. Richie did not want to handle his car accident claim without a lawyer. He had heard that car insurance companies (like GEICO) take advantage of people who don’t have a lawyer.

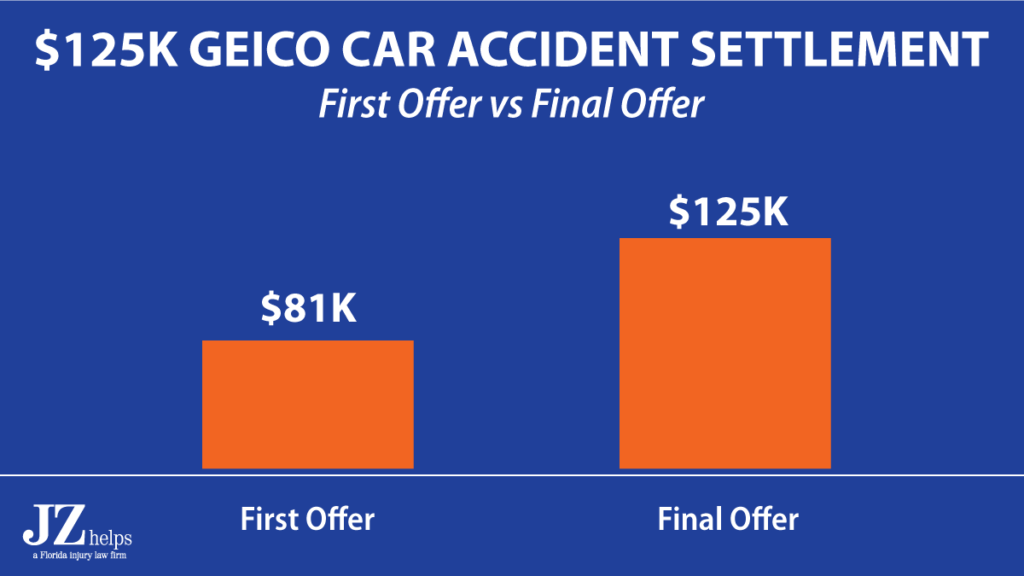

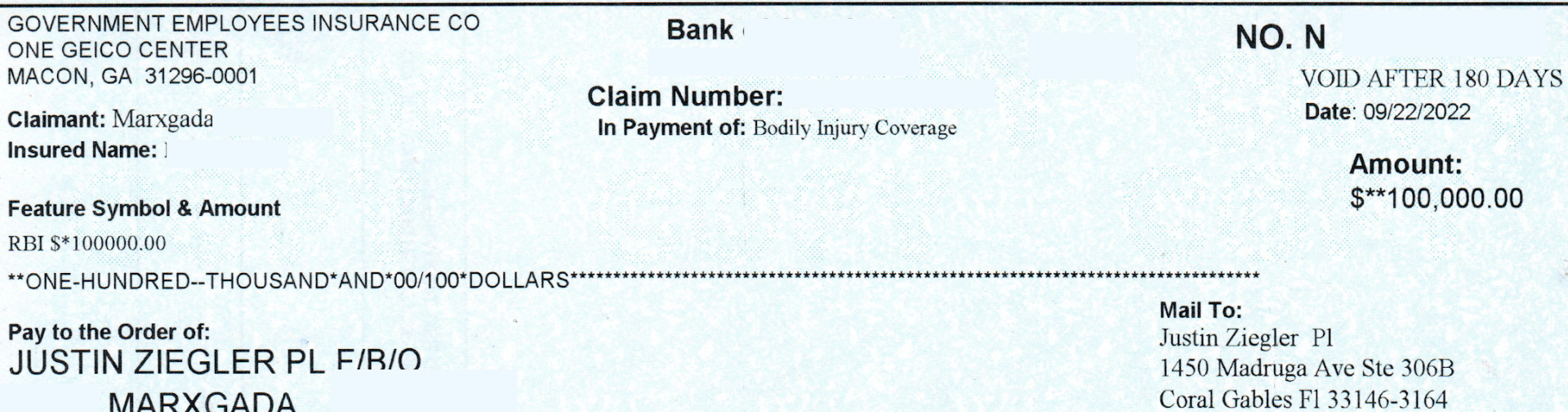

Thus, he got a free consultation with me. He hired me. GEICO insured the other driver. GEICO made a first offer to settle of $81,000.

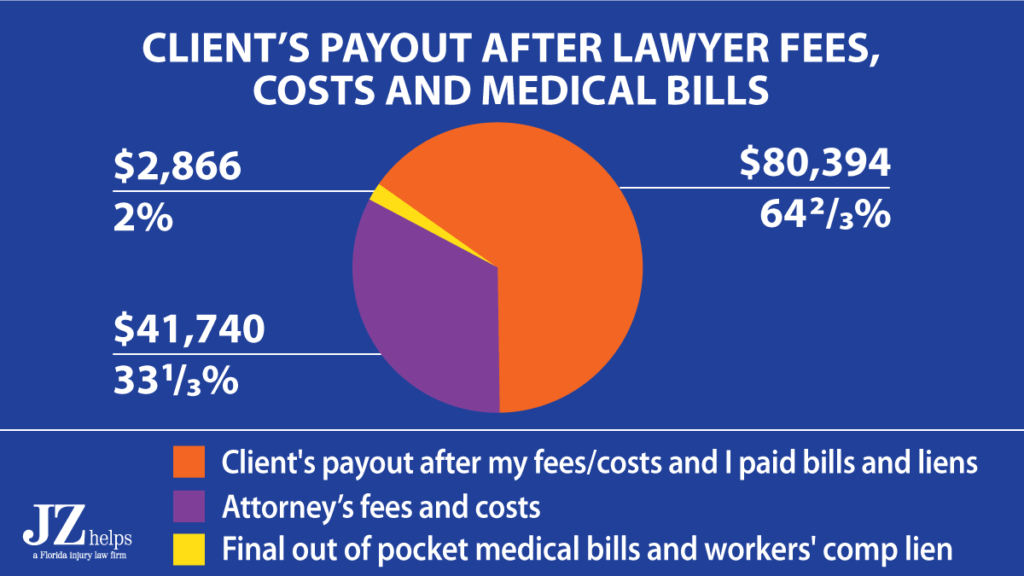

After intense negotiation, I settled his personal injury case with GEICO for $125,000.

After my attorney’s fees, costs and paying back his workers’ compensation insurer, Richie got a check for .

Richie was very happy with the amount of his car accident injury settlement.

Take a look at his glowing smile:

Pedestrian Hit By Car Gets $110,000 Settlement for Face Fracture

A car hit a pedestrian in Homestead, Miami-Dade County, Florida. She had fractures in face, resulting in surgery. Imperial Fire & Casualty Insurance (RAC partners) insured the driver.

We settled for $110,000. She was very happy with the amount of her car accident injury settlement.

$104,000+ Car Accident Settlement

Don (not real name) was driving his car through an intersection in Miami, Florida. Don had a green light. Another driver ran a red light and crashed into Don.

Immediately after the accident, Don had leg pain from the accident. Paramedics came to the scene and took him to the hospital.

At the hospital, an x-ray of Don’s leg showed that he had a broken leg. Don got a free consultation with me to see if I could represent him. Immediately after we spoke, he hired me.

I requested the crash report and saw that the other driver got a ticket for running the red light.

Fortunately, Don did not need surgery.

The other driver’s insurance company only offered $5,000 as a personal injury settlement! They battled with us for a while and increased their offer to close to $16,200.

Don’s orthopedic doctor said that he may need surgery in the future if his leg becomes unstable. However, this doctor did not say that Don will need surgery, which (if true) would’ve likely added much more value to his case.

I asked his doctor to send me a written estimate of the cost of the leg surgery. I then sent that estimate to the other driver’s insurance company.

The written estimate of the cost of a possible future surgery was the biggest factor that got the other driver’s insurance company to significantly increase their offer.

I fought hard and got Don a settlement of over $104,000. After my lawyer fees, costs and paying his medical bills, Don received over $67,000 in his pocket.

If Don would’ve had surgery to his leg, the settlement likely would have been much higher.

This is one of my biggest settlements for a fractured bone where my client did not have surgery.

$100,000 Car Accident Injury Settlement in 2022

Claude was driving a car on I-95 near Ormand Beach, Florida. Mar was a passenger in the car.

Claude crashed into the back of an 18 wheeler (tractor trailer).

Look at a damage to the car’s driver side and front:

Here is a photo of the damage to the facing the passenger and front side of the car:

The hard impact caused a gash (cut) to Mar’s chin. She had a loss of consciousness.

An ambulance took Mar to the hospital. At the hospital, they diagnosed her with a collapsed lung (pneumothorax). They also used a few stitches to close up the wound on her chin.

After the accident, Mar got a FREE consultation with me to see if I could represent her in her personal injury claim. We spoke, and she quickly hired me.

I jumped into action to protect Mar’s rights.

GEICO insured the driver of the car with $100,000 in BIL coverage. Fortunately, Mar was able to return to work.

You can see the scar on her chin from this accident:

I did a thorough investigation to see if I could find additional insurance coverage. Unfortunately, there was no additional insurance coverage.

Like most Floridians, Mar did not have uninsured motorist insurance on her car, which would have likely paid additional money.

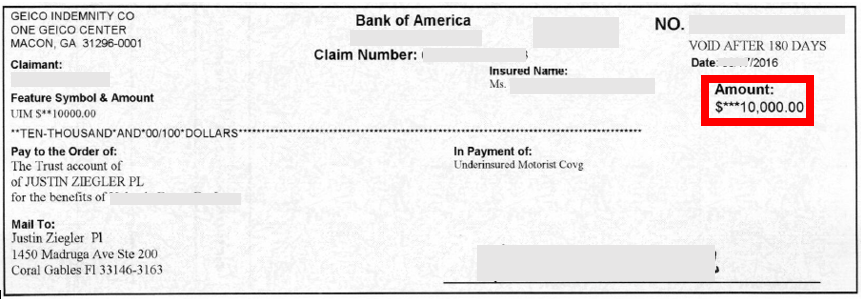

I settled Mar personal injury case with GEICO for the $100,000 insurance limits. Here is GEICO’s settlement check (redacted).

After my lawyer fees, costs and paying her medical bills, Mar got over $58,100 in her pocket!

The best part?

She is very happy with the settlement.

This photo captures Mar’s gratitude with the settlement:

$100,000 Car Accident Settlement (2021)

Igor (not real name) was hit by a car in Miami, Florida. The at fault driver’s insurance company settled with us $100,000.

$100,000 Payout for Auto Accident Injury

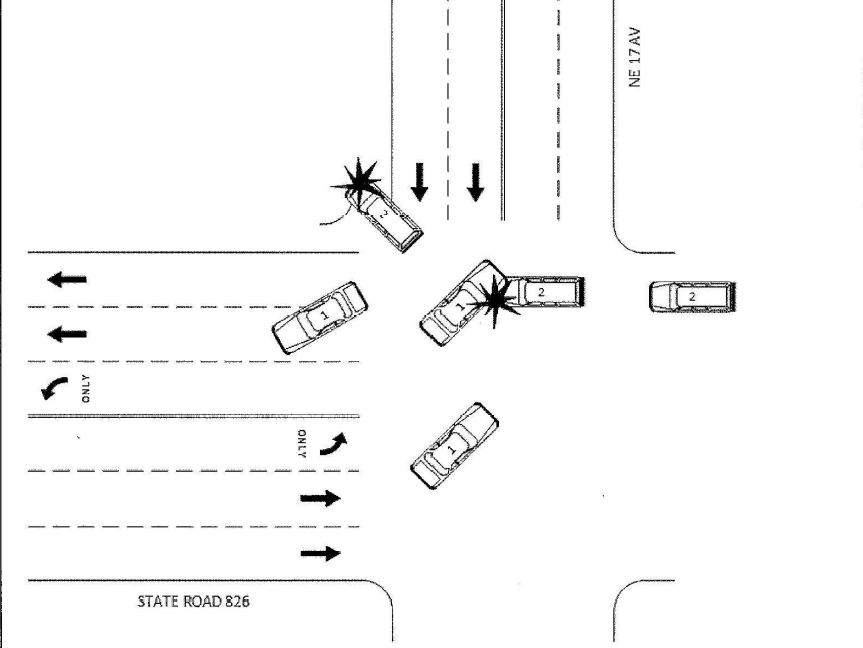

Keith was driving of a car in Coconut Grove, Miami-Dade County, Florida. Another car crashed into the back of the car that Keith was in.

Here is a photo of the crash scene.

The crash reported listed his injuries as possible. His airbag didn’t deploy.

Keith was not transported to a hospital.

About eight months after the crash, Keith had terrible lower back pain. His father ordered an MRI.

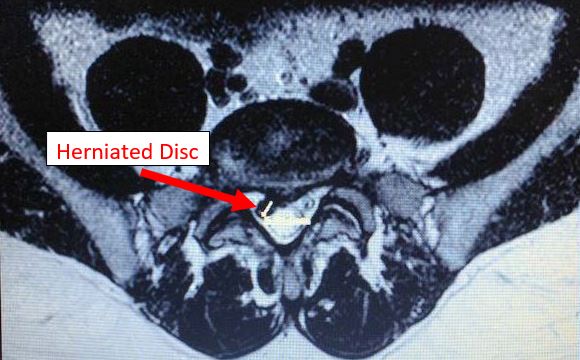

An MRI of his lumbar spine (lower back) showed a herniated disc at L5-S1. Here is the view of his herniated disc from the side.

Below is another view of the herniated disc.

Here, the view of the MRI is looking from top down.

His dad referred him to a neurosurgeon.

He had back surgery.

Specifically, he had a L5-S1 hemilaminotomy, medial facetectomy and microdiskectomy, using a microsurgery.

Here is an illustration of a discectomy.

This is in the incision from the surgery.

He was left with a small scar on his lower back from the surgery.

A quick word about compensation for scars

Now:

A scar on your lower back isn’t worth as much as a scar on a your face. Also, a scar on a man isn’t worth as much as the same scar on a woman.

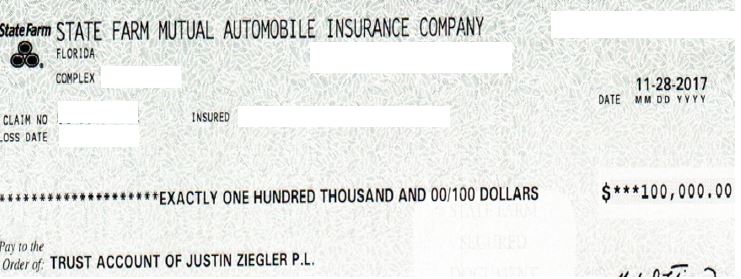

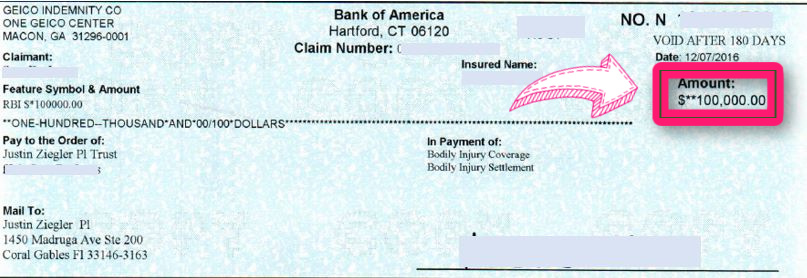

We sent State Farm a written request to give me certain insurance information required by Florida Statute 627.4137.

State Farm insured the other driver. I got State Farm to offer the $100,000 bodily injury liability (BIL) limits. And this was without a lawsuit in this car accident case.

Here is the $100,000 settlement check.

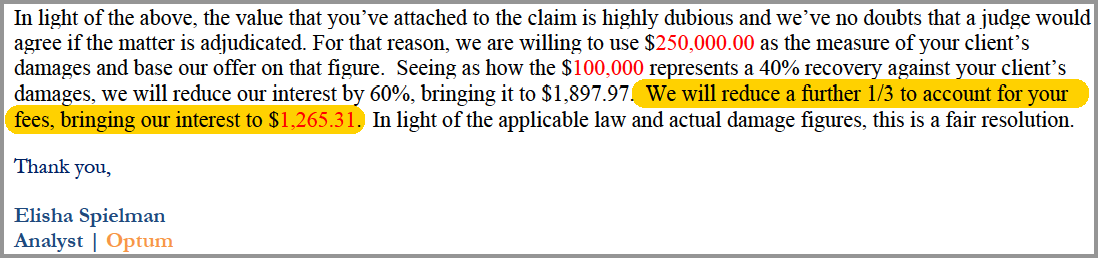

Keith’s health insurance company demanded that we pay them from the settlement. They are entitled to get paid back from a Florida car accident settlement.

I got his health insurance company to accept a fraction of what the they paid:

He would not have been able to get this discount without a lawyer.

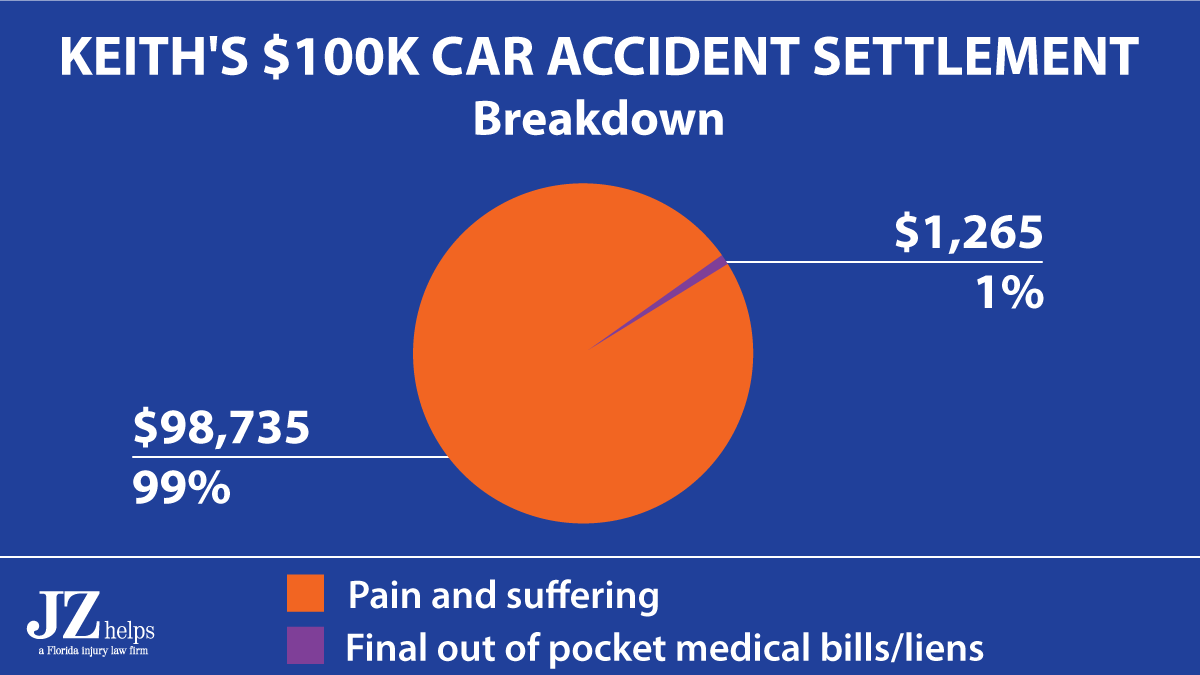

I estimate that 99% of the settlement was for Keith’s pain and suffering.

Take a look:

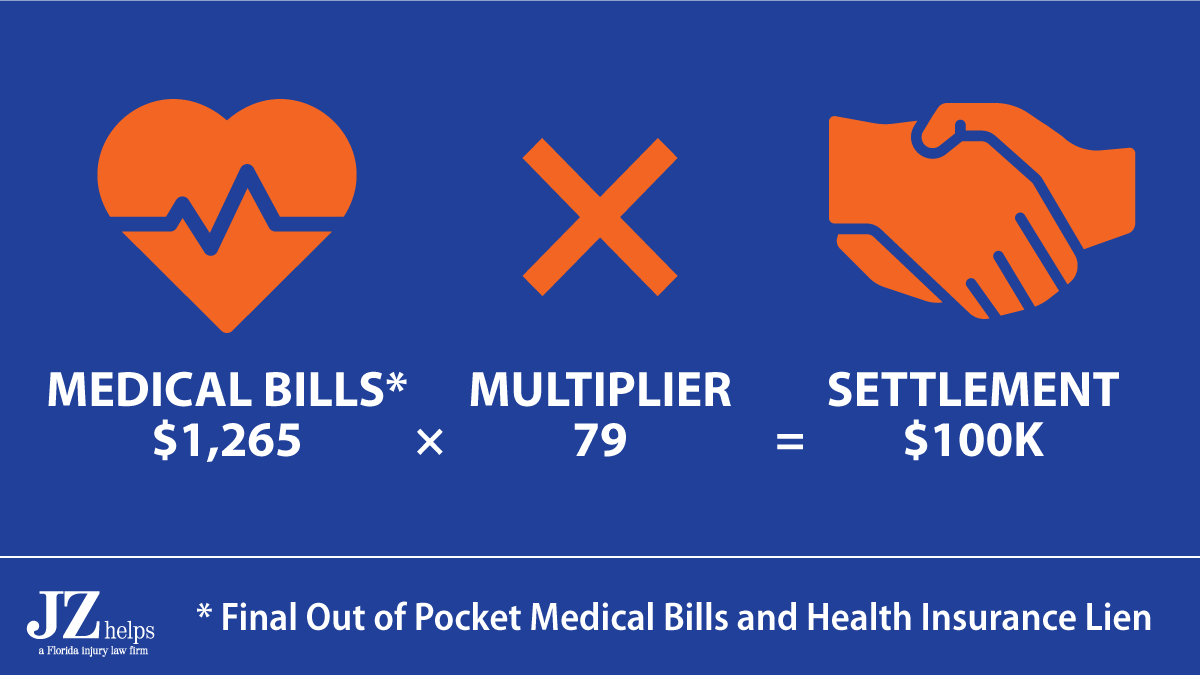

Basically, the total payout was 79 times Keith’s out of pocket medical bills and health insurance lien that I paid.

He was very happy with his settlement.

Here is a photo of Keith and I.

$100K Car Accident Injury Settlement (in Under 4 Months)

Sara was driving her car in North Miami Beach, Florida. Another car was heading in the opposite direction. The other car made a left turn into Sara’s right of way. They crashed into each other.

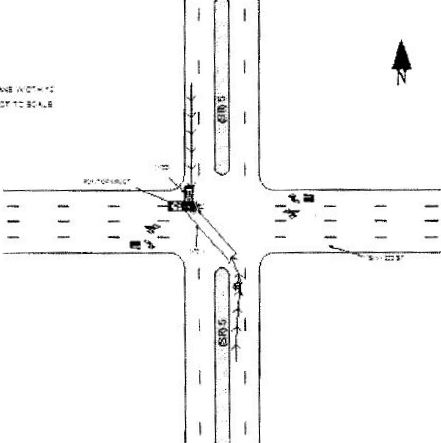

Sara was driving car #1 in the crash diagram below:

Check out the damage to Sara’s SUV.

The front seat airbags deployed.

Here is a photo of the other driver’s car:

Paramedics took Sara to the hospital.

At the emergency room (ER), she took this selfie:

Sara broke her nose. After the accident, she hired me as her lawyer.

She said the crash worsened her pre-existing bulging discs and herniated discs.

She had car insurance. Florida is a No Fault state. Therefore, her personal injury protection (PIP) paid her doctors $10,000 for her medical bills. Florida is one a few states that has No-Fault insurance.

Sara had a nerve block injection to her lower back. A neurosurgeon recommended lower back surgery.

GEICO Insured the At Fault Driver

I sent GEICO a letter to GEICO asking them to tell me the at fault driver’s insurance limits.

When I make a claim against my client’s uninsured motorist insurance coverage, I send a different letter.

In most cases, I like to make sure that a claim has already been set up with GEICO before sending my request for their insurance limits.

Why?

My letter gets to the correct adjuster faster.

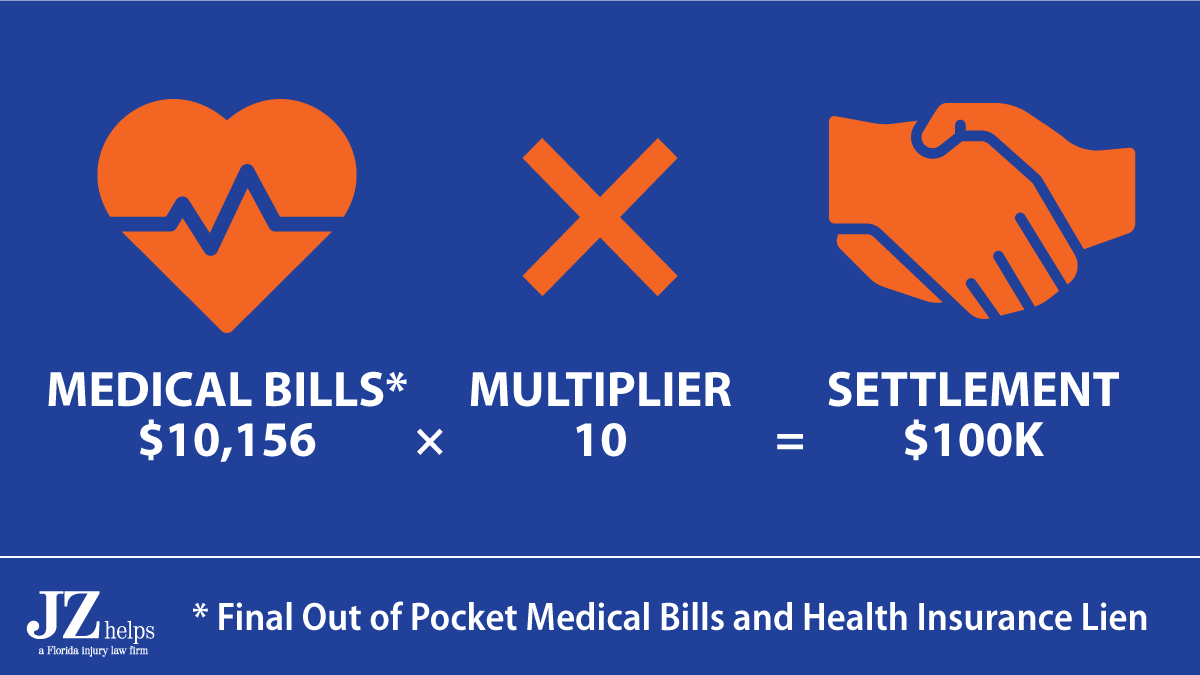

GEICO paid its $100,000 BI insurance limits about three months after the collision.

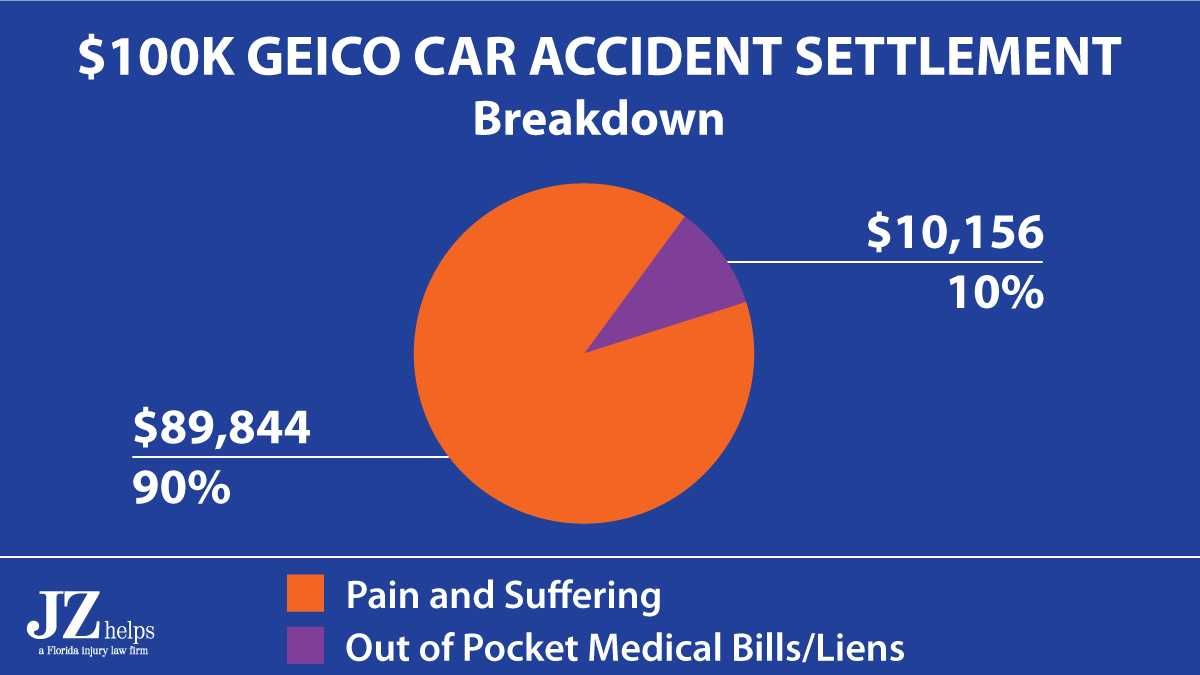

As you can see, 90% of this settlement was for pain and suffering:

When a car insurance company makes you a settlement offer, they do not factor in your attorney fees.

The rest of this $100,000 payout was for her out of pocket medical bills and health insurance lien.

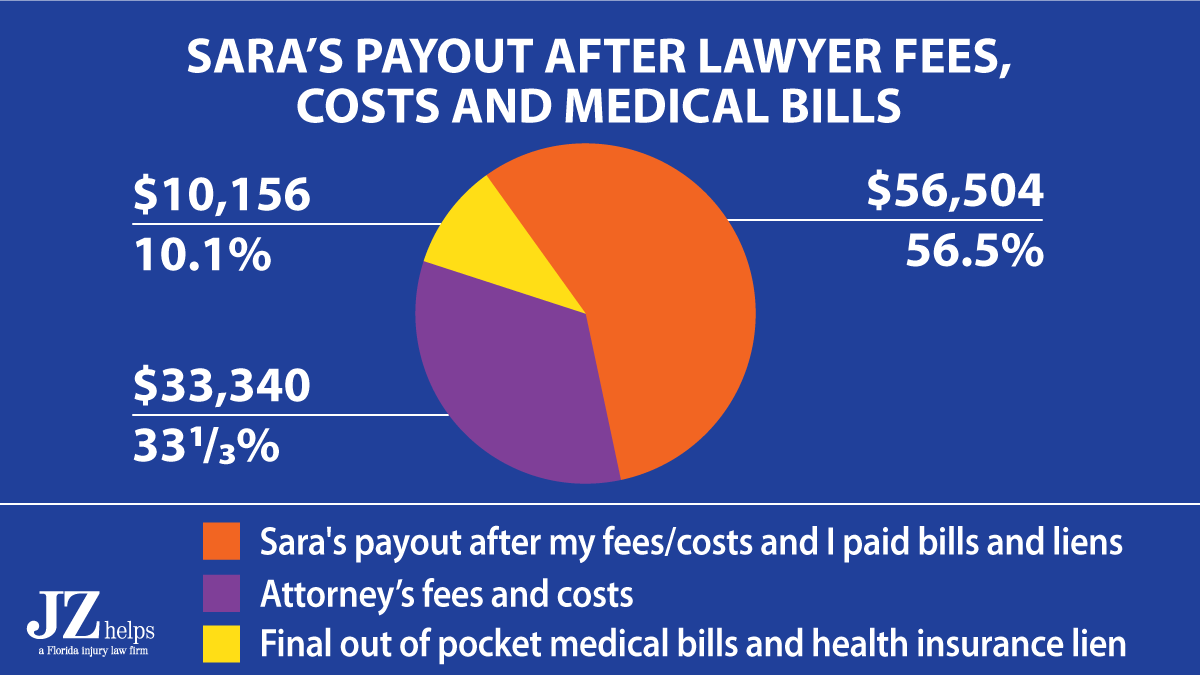

After my attorney’s fees, costs, and paying off Sara’s medical bills and health insurance liens, she got $56,504 in her pocket.

Sara’s settlement was a little less than 10 times her final medical bills and health insurance lien.

She was very happy with her settlement.

$100K Car Accident Injury Settlement (Motorcyclist Hit By Car)

A motorcycle rider was hit by a car in Miami, Florida. We claimed that that the crash caused or worsened his herniated disc. He also had a meniscus tear.

In addition, I alleged that the crash caused his erectile dysfunction (ED).

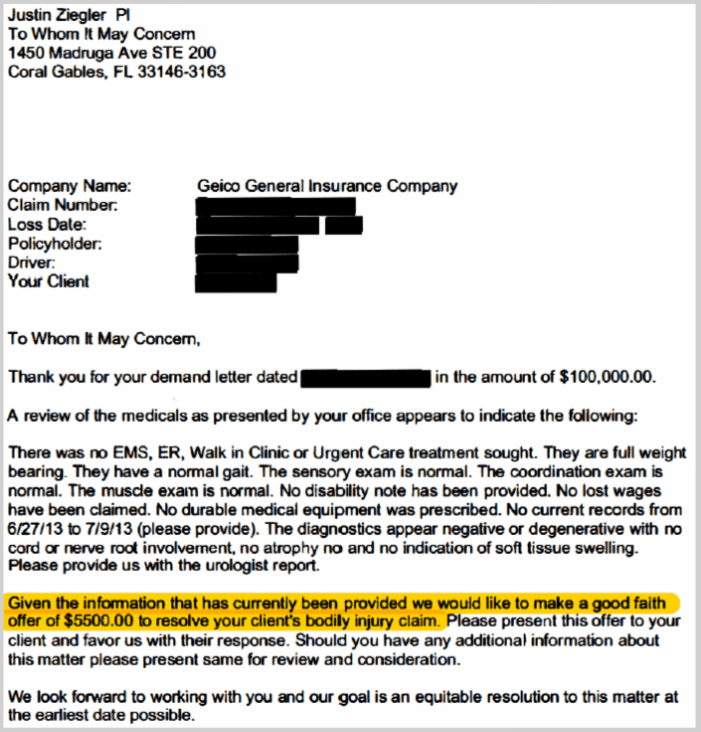

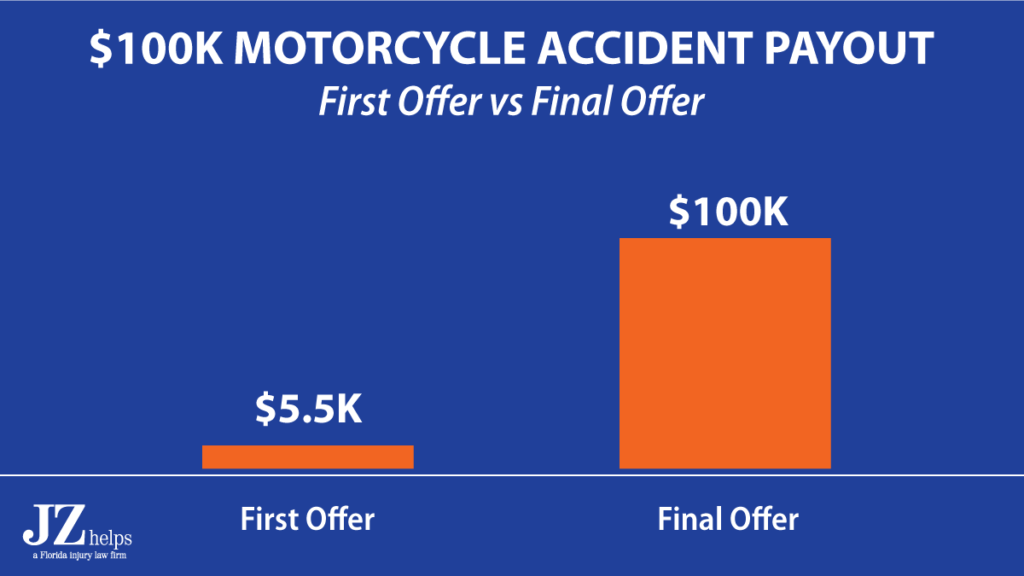

I demanded the other driver’s $100,000 bodily injury liability limits. Unfortunately, GEICO’s first offer was only $5,500. Look at the letter that they sent me:

Their letter seems convincing, right?

If my client did not have an attorney, he may have believed GEICO. After all, they said they were making a good faith offer. They were not.

I again told GEICO that we would not settle for under the driver’s $100,000 BIL limits. GEICO made another lowball offer.

My client claimed that he had erectile dysfunction since the accident. He did not have health insurance. Thus, I paid for his one time medical evaluation with a urologist. A urologist is a doctor who treats injuries to the mail reproductive organs.

GEICO offered to mediate this case. Mediation is where a third party tries to get the injured person and GEICO to settle.

At mediation, GEICO offered the $100,000 BIL coverage limits to settle. This was during the 8 month after the accident.

We settled with GEICO for the $100,000 BIL limits.

Here’s a comparison between the first offer and the final settlement:

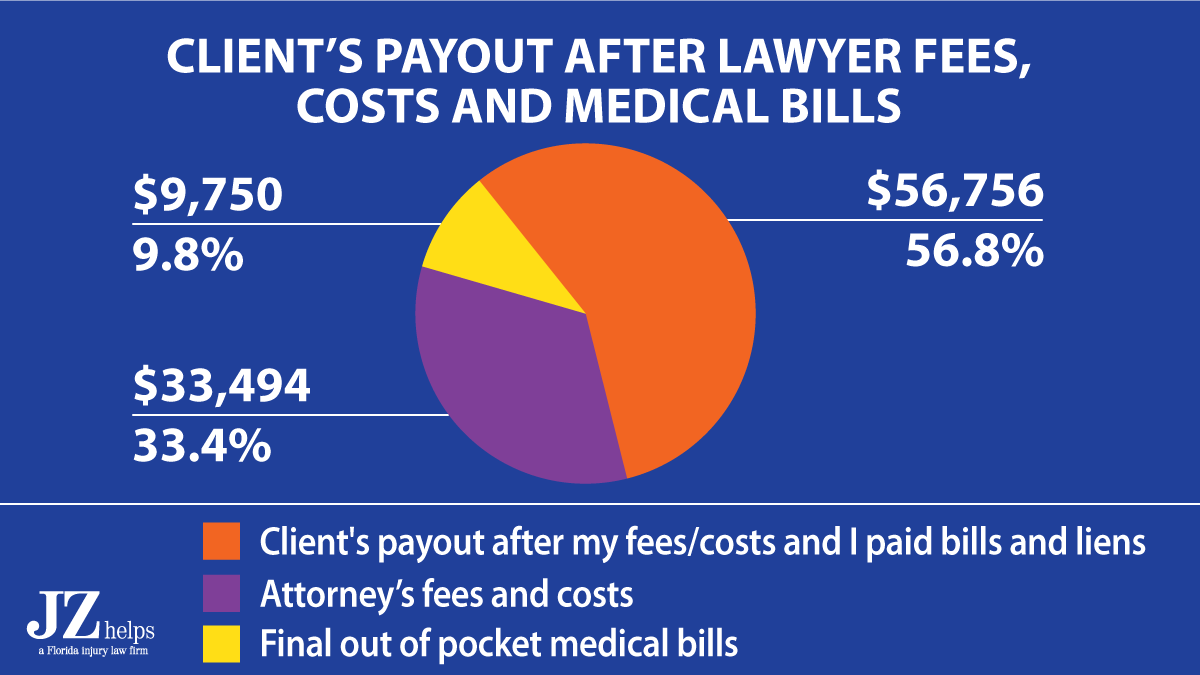

After my attorney fees and costs, and paying my client’s medical bills, I gave him a check for $56,756.

Take a look:

$100K Settlement for Driver of Car Hit By a Truck ( Herniated Disc)

A man was driving his car, heading straight. A 18 wheeler truck coming in the opposite direction made a left hand turn. The car crashed into the 18 wheeler.

Shortly after this accident, the driver of the car heard about us (Miami car accident lawyer Justin Ziegler). His relative referred him to us. We gave the driver a free consultation.

Let Me Fight to Get You a Fair Settlement

Immediately after we had this free consultation, he hired us. The driver of the car claimed that the car crash caused or aggravated his C5-C6 herniated disc.

Zurich Insurance Company insured the tractor trailer.

$100K Settlement (Policy Limits)

For a woman who had facial fractures when she was hit by a Ford F-150 truck while she was on or pushing her bicycle across an intersection.

It happened in Cooper City, Broward County, Florida. The at fault party had $100,000 in BI liability coverage.

She was airlifted to the hospital by Broward County Air Rescue. Unfortunately, as is too often, are client didn’t have uninsured motorist insurance which would have given her the opportunity to get many more thousands of dollars.

This story made the Sun Sentinel newspaper as well as the Miami Herald.

I contacted a representative of Memorial Regional Hospital in Hollywood, Florida. She reduced my client’s hospital bill after I sent a written request to reduce medical bills.

Unfortunately, my client ‘s son-in-law (resident relative) did not carry underinsured motorist (UIM) insurance on his car. Thus, his auto insurance company did not have to pay her any additional money for UIM benefits.

$100K Settlement for Back Surgery (Rear-End Car Accident)

A woman was driving her car in Homestead, Miami-Dade County, Florida. Another driver crashed into the back of her car.

She had a bulging disc. A doctor gave her epidural steroid injections to her lower back. She had lower back surgery (a percutaneous discectomy).

Liberty Mutual insured the truck driver with $100,000 in bodily injury liability (BIL) insurance.

They claimed that the woman hit the car in front of her before the truck driver hit her car. Liberty Mutual put 50% blame – for causing the accident – on the woman.

MGA Insurance Company insured the claimant’s car.

$100K Settlement for Passenger Who Had Thumb Surgery (Car Accident)

The Property & Casualty Insurance company of Hartford paid $100,000 to a passenger in a one car collision. The driver of the car pressed the accelerator instead of the brake.

She drove into a fixed object. The passenger had thumb surgery as well as pain in his knee, a head injury, neck pain and lower back pain.

$100K Car Accident Injury Settlement

Brad (not real name) was an occupant who was injured in a car accident in Florida. He claimed that the crash caused or aggravated his herniated disc.

We settled his personal injury case for $100,000.

$100K+ Auto Accident Settlement

Jose (not real name) was an occupant who was injured in a car accident in Florida. He claimed that he was injured in an auto accident.

We settled his personal injury case for over $100,000.

$95K car accident injury settlement

Frank (not real name) was driving his car in South Florida. Another driver hit him head on. At the accident scene, the other driver was arrested for drunk driving.

Frank did not take an ambulance to the hospital. Shortly after the accident, he called me for a free consultation. After we spoke, he hired me.

Frank had neck and back pain. I told him that he could go see a doctor for his pain. He did so. The doctor ordered an MRI of his spine.

The MRI showed that he had herniated discs. However, he did not injections or surgery. He got a few months of therapy with a chiropractor.

GEICO insured the drunk driver. GEICO’s first offer was for $17,500. Soon thereafter, I settled his injury case with GEICO for $95,000.

The best part?

We settled without suing. This kept my attorney’s fee at 33 1/3% of the total settlement instead of increasing to 40%.

$90K Car Accident Injury Settlement

In May 2019, Alice was walking as a pedestrian in South Florida. Sofia was driving a car. Sofia’s car hit Alice. Progressive insured Sofia. After the accident, Sofia called 911. Paramedics came to the scene.

She complained of leg and pain to her face around her eye. Her glasses broke in the fall. They took Alice to the hospital.

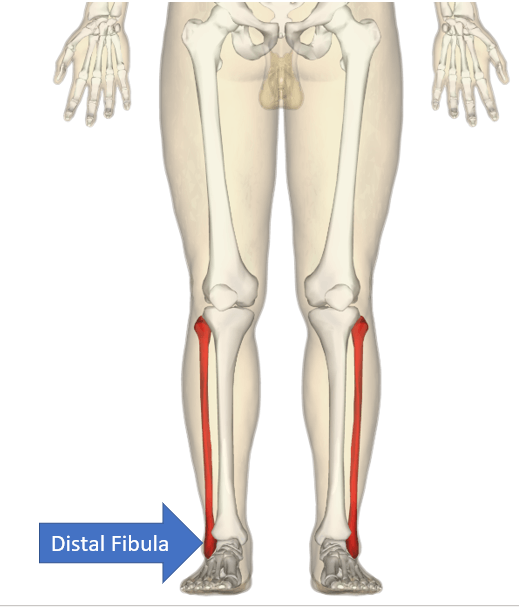

They took a CT scan of her head. However, it did not show that she had a head injury. Ultimately, an x-ray showed that she had a fracture of the distal fibula.

This is the part of the smaller lower leg bone that is closer to the ankle. Basically, she had an ankle fracture.

Alice’s relative searched for Miami car accident attorneys. She saw that I had settled many personal injury cases with Progressive. In one of these cases, Progressive’s settled with me for $100,000 after a pedestrian who was hit by a car.

But that was not it. Additionally, I settled another case for $65,000 where a pedestrian was hit by a car and broke his ankle. She also saw our 5 star rating on Google maps. She called me and got a Free consultation to see if I could represent her relative. Next, she recommended to Alice that she hire me.

Alice called me. After we spoke, she immediately hired me.

I quickly jumped into action. We requested Progressive’s insurance limits. I requested the audio recording of the 911 call. On the call, the driver said that she had an accident. Sofia said that Alice walked into her car.

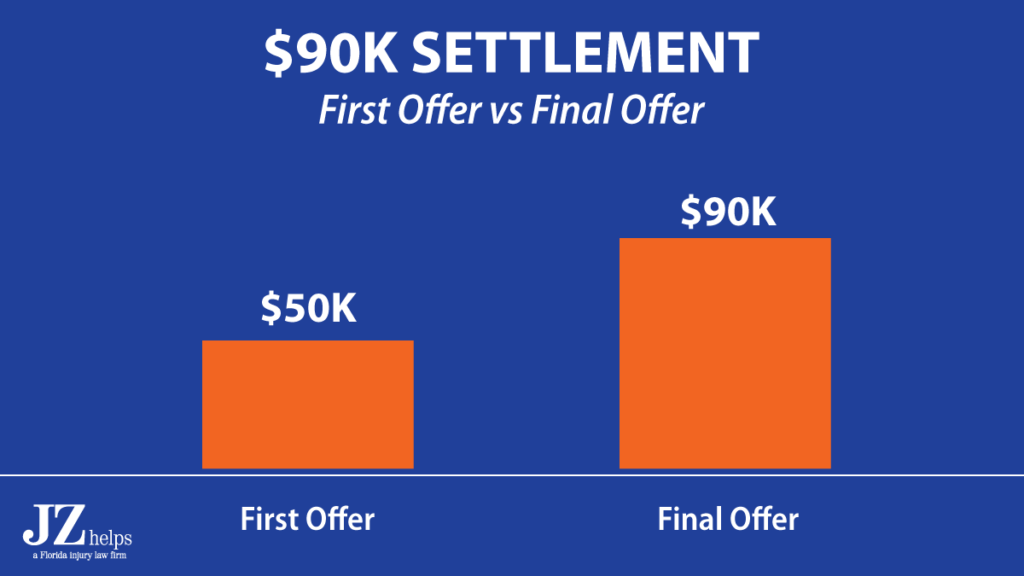

Progressive’s First Offer Was $50K

Progressive initially assigned bodily injury liability adjuster David Toro to handle the claim. We told Progressive to pay for Alice’s broken eye glasses. They paid for a new pair.

David offered us $50,000 to settle Alice’s bodily injury claim. We refused it. Later, Progressive assigned large loss/litigation adjuster Greg Paulson to the case. Greg increased Progressive’s offer to $55,000.

He told me that he did not see her claim as being worth $100,000 for several reasons. First, he blamed Alice for walking in front of his insured’s car.

I disputed this by providing Greg with a photo of the accident scene. It showed that the driver had a clear line of sight and should not have hit Alice.

Second, Progressive argued that Alice did not have surgery to her ankle. As I’ve said before, surgery greatly increases the value of the case. Greg told me that he felt that the claim was worth somewhere around $75,000.

I aggressively negotiated this claim with Progressive. Finally, Greg increased his offer to $90,000. In November 2019, I settled the bodily injury case with Progressive for $90,000.

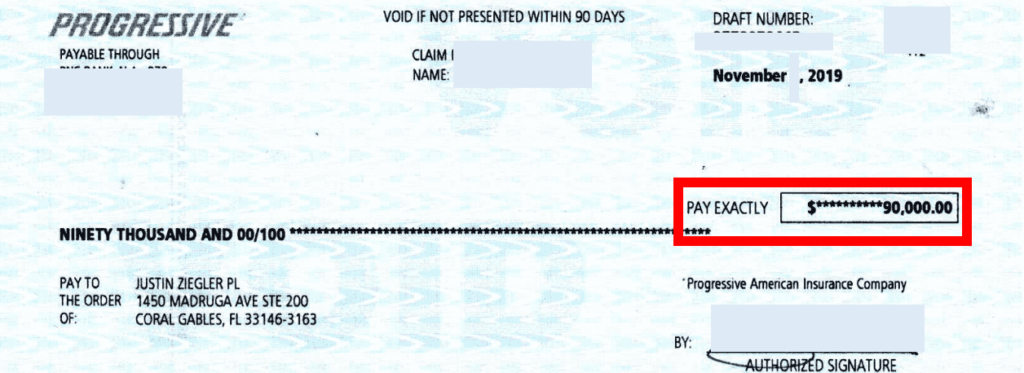

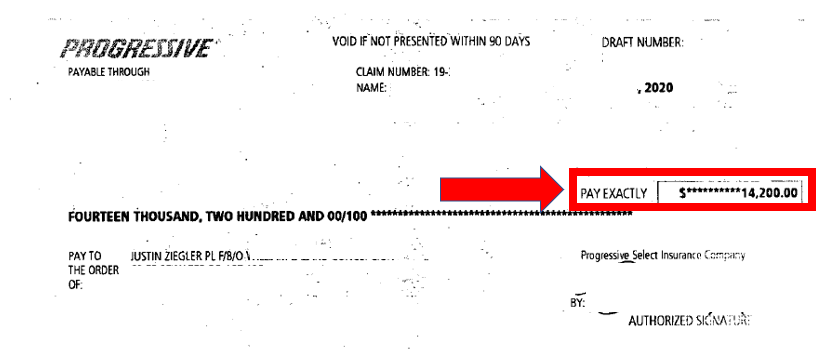

Here is Progressive’s settlement check:

Take a look at Progressive’s first offer as compared to their final offer.

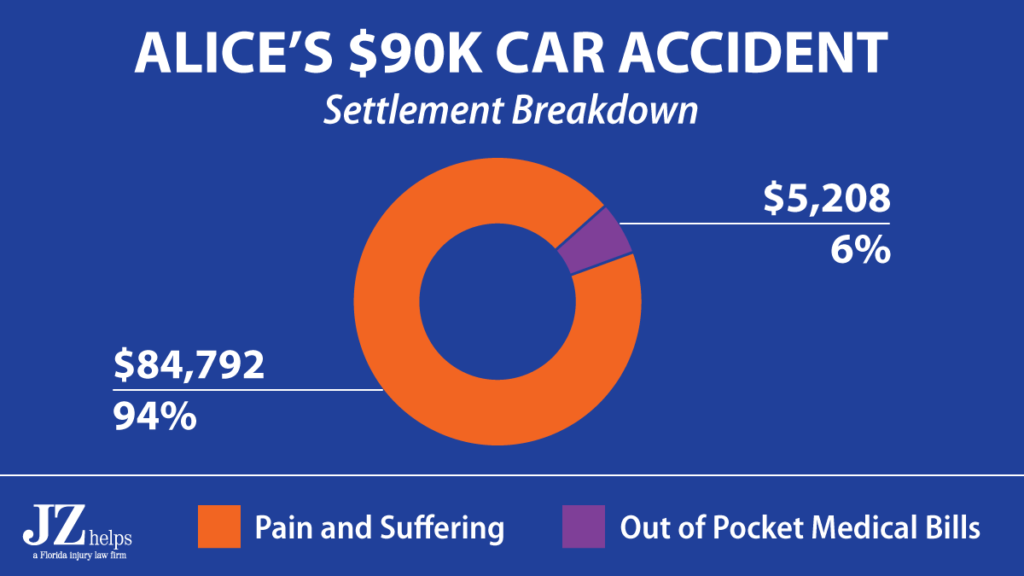

Now, let’s look at how much of the settlement was for pain and suffering vs medical bills.

95% of the Settlement Was for Pain and Suffering

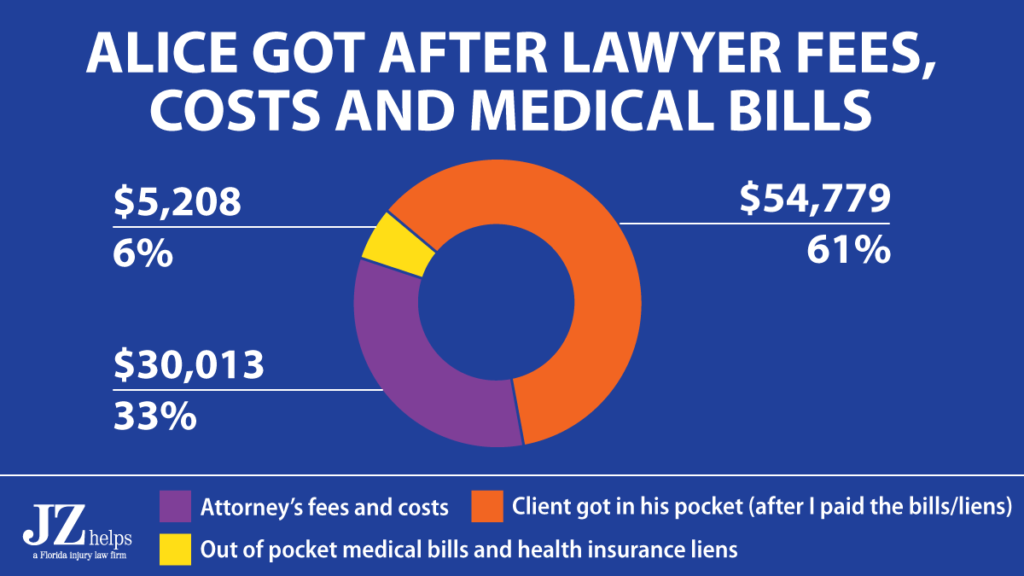

Here is a pie graph that shows the breakdown (of the settlement) between pain and suffering and medical bills:

As you can see from the pie graph above, 94% of the settlement was for pain and suffering. About 6% of the settlement was for medical bills.

After my contingency fees and costs, paying Alice’s out of pocket medical bills and health insurance lien, she gets over $54,000. That is her portion of the settlement.

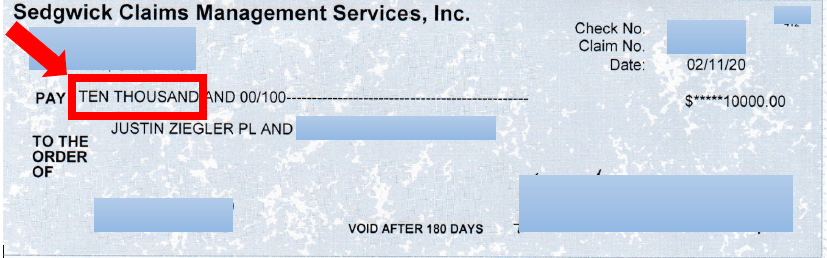

Since Alice owned a car, she used her PIP coverage to pay for her medical bills. United Auto Insurance Company (UAIC) insured Alice’s car. Her out of pocket medical bills were low because United’s PIP paid for $10,000 of her medical bills.

The best part?

We got this payout without having to sue. This benefited my client because my attorney’s fee was capped at 33 1/3% of the total settlement.

If I would have sued, my attorney’s fee would have shot up to 40% of the settlement. Also, my client avoided the stress and increased costs associated with a car accident lawsuit. I do not sue just to drive up my fees.

My client was very happy with this $90,000 settlement.

$75K car accident injury settlement

Woman had arthroscopic knee surgery and a bulging disc as a result of a car making a left hand turn in front of her in Miami near Coconut Grove, Florida.

Progressive was the bodily injury liability insurer for the other car. The other car was cited for failing to yield the right of way.

Allstate was the underinsured motorist (UIM) auto insurer. Progressive paid $50,000 and Allstate paid $25,000. You can read more about this $75,000 settlement for knee surgery and bulging disc from a car accident in Miami.

Lyft Passenger Gets $70K Settlement for Car Accident in Miami Shores

See a $70,000 settlement for a passenger who was in a Lyft car, when another car hit it. He claimed the crash caused neck, back, wrist and ankle injuries.

$70K Car Accident Injury Settlement

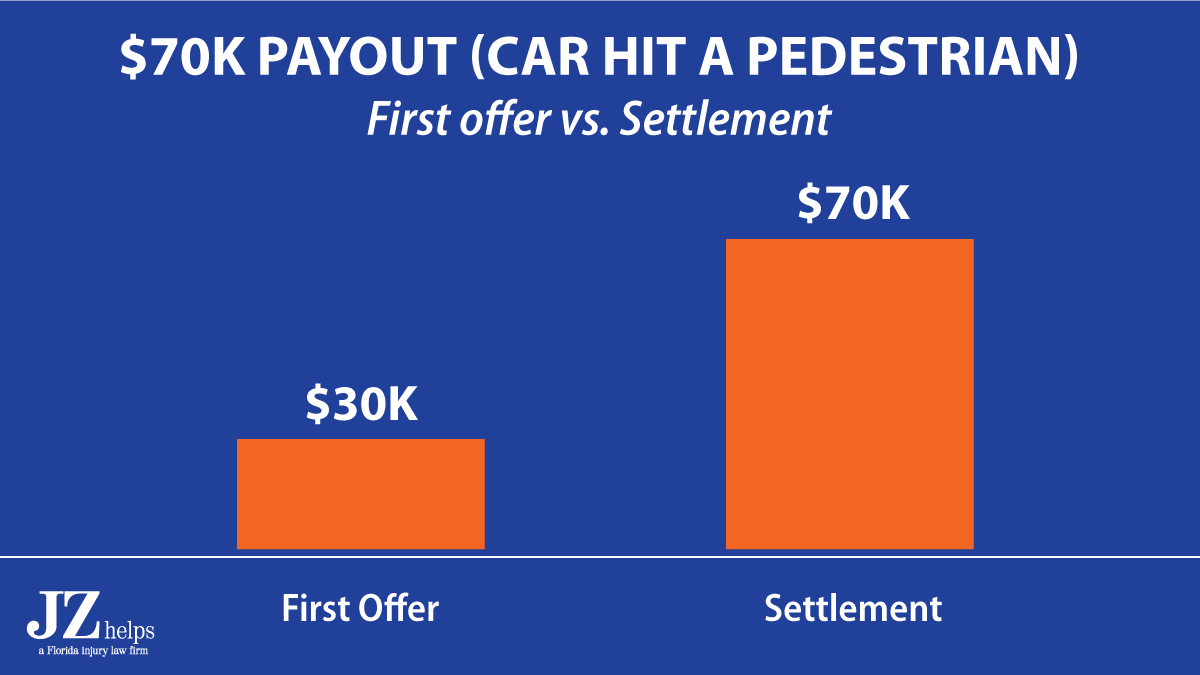

A pedestrian was hit by a car while not in a crosswalk. USAA insured the car that hit her.

She had a tibial plateau fracture, sacrum fracture, herniated discs and shoulder impingement. Fortunately, she did not need surgery.

USAA’s first offer was only $30,000. Ultimately, I got her a car accident injury settlement of $70,000.

Here is the comparison between the first offer and settlement:

$65K Car Accident Injury Settlement

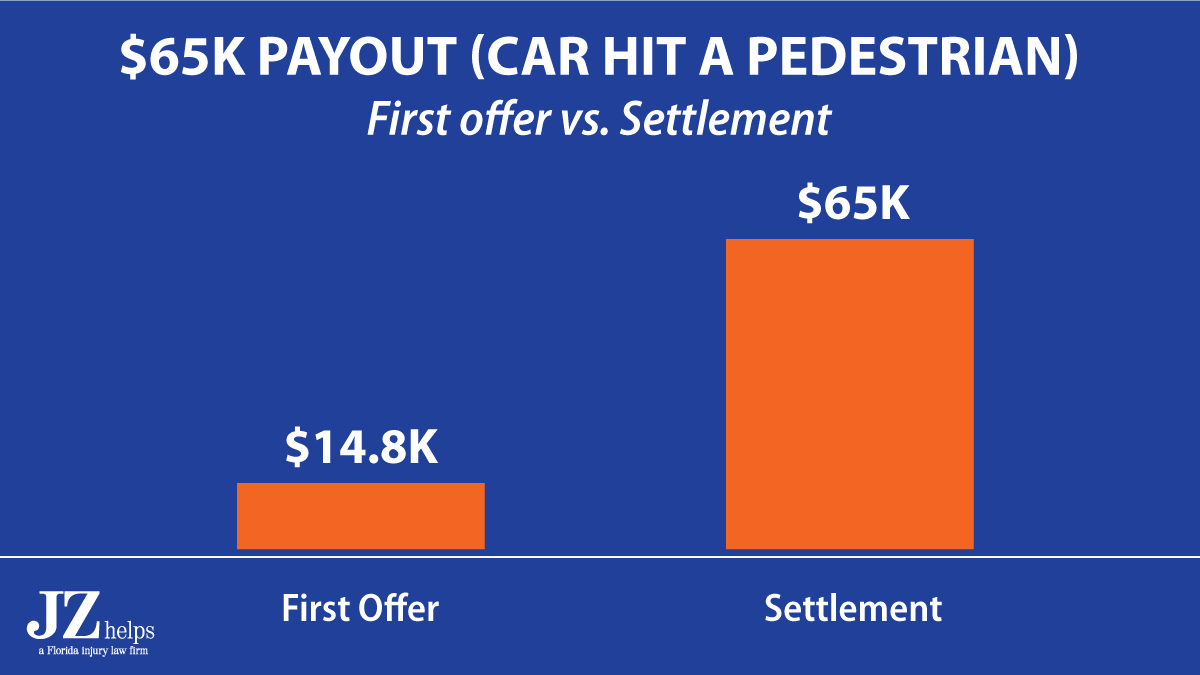

Doug was vacationing in Miami Beach, Florida. While he crossed the street, a car hit him. GEICO insured the at fault car.

Doug broke his lower leg (fibula). Fortunately, he did not need surgery.

After the accident, Doug hired me as his lawyer. At first, GEICO offered only $14,780.15 to settle this case.

Ultimately, I settled Doug’s case for $65,000.

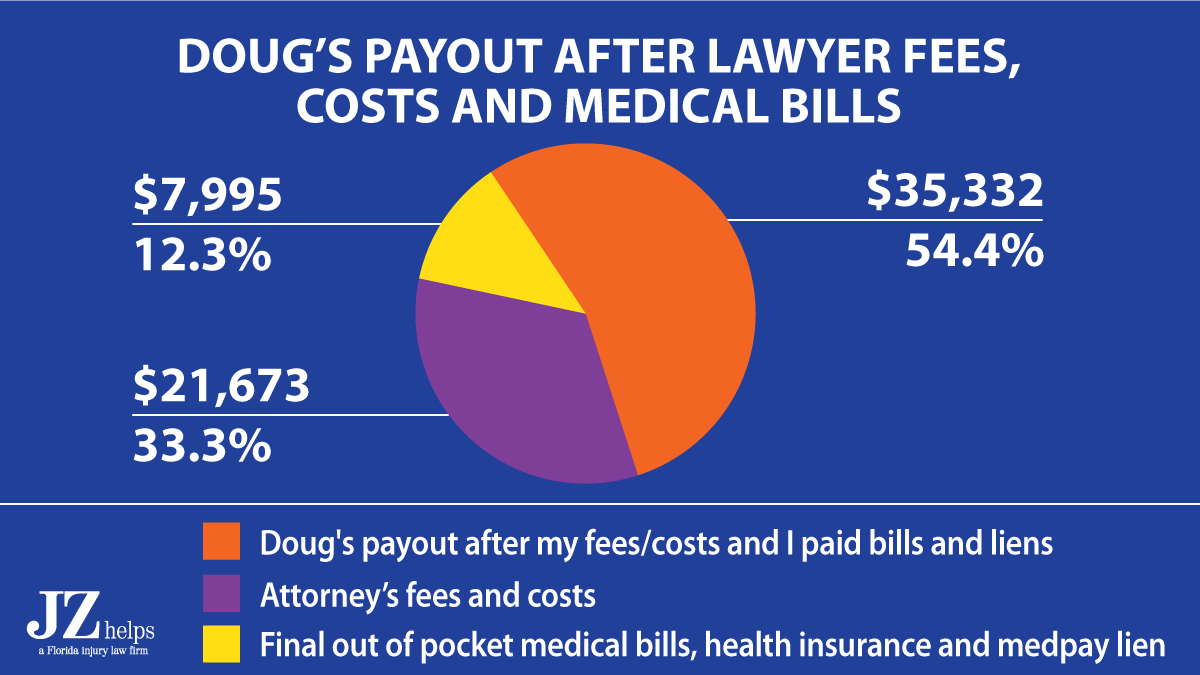

Medicare, AARP (United Healthcare), Farmers Insurance (med pay) paid the bulk of his medical bills. Thus, he had to pay them back from the settlement.

The good news?

When it came time to pay them back from the total settlement, they all reduced their liens by my attorney’s fees and costs. That is a big advantage to hiring a lawyer in a car accident claim.

After my attorney fees, costs and paying his out of pocket medical bills and liens back, Doug got $35,332 in his pocket.

Doug was thrilled with his car accident injury settlement.

He sent my paralegal flowers and this thank you card:

$65K Car Accident Settlement (Shoulder Surgery from Rear Ender)

A for a lady was rear ended in a Orlando, Florida car crash. After the accident, she had surgery on a full thickness rotator cuff tear.

I sued for her. We settled her car accident injury lawsuit for $65,000.

$57,600 car accident injury Settlement

For a woman in her twenties who was involved in a multi car collision. Her injuries ultimately resulted in arthroscopic shoulder surgery to her non-dominant shoulder. The insurance companies for the responsible parties were GEICO and Progressive.

The liability limits of bodily injury insurance for one of the at fault insurance companies was limited to $10,000. Her car sustained minor to moderate damage. Her shoulder healed well following surgery.

$57K car accident injury settlement

An on-duty police officer was stopped in traffic, when another car rear ended him. The crash happened in Medley, Florida (North Miami-Dade County).

The driver who caused the accident received a ticket for following too closely. State Farm insured the careless driver.

State Farm Insurance paid us the careless driver’s $10,000 BI limits.

The officer said that the wreck caused or aggravated his bulging disc.

A doctor gave him epidural steroid injections to his lower back. The cop was a candidate for lower back surgery (lumbar laminectomy). He did not have surgery.

Travelers Insurance insured the police officer’s personal car. However, he wasn’t using his personal car when the car hit him.

Workers compensation for the police department paid over $17,000 in indemnity (lost wages) and medical benefits.

I settled the UIM case with Travelers for $47,000. Thus, State Farm and Travelers paid a combined $57,000 for the personal injury case.

$54,900 Auto Accident Settlement

My client was injured in a car accident. I settled the case for $54,900.

$52,500 Settlement

A driver of a car hit a bike rider. We claimed that the accident caused or worsened his herniated disc and compression fracture.

$52K Settlement (Van Hit Scooter Rider)

On behalf of a 26-year-old man who was injured (while he was on a scooter/moped) when a NAPA van’s front end crashed into the moped. According to the police report, the driver of the van stopped and rendered aid but then fled the scene without giving any information.

The driver of the van was later stopped. Miami-Dade Fire Rescue treated the driver of the moped on the scene. The driver of the van received a citation for failure to yield at intersection.

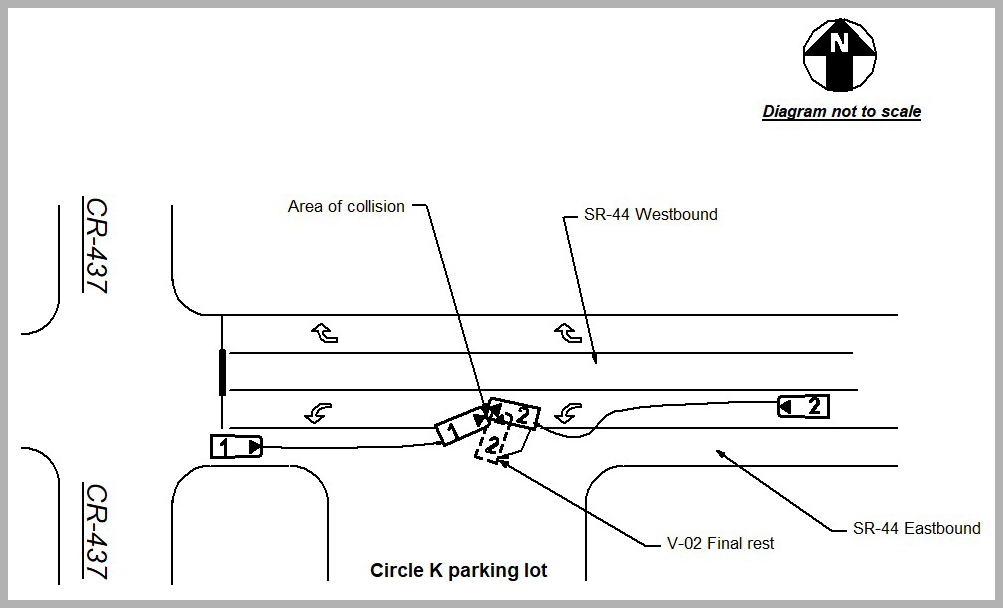

$50K Car Accident Settlement (2021)

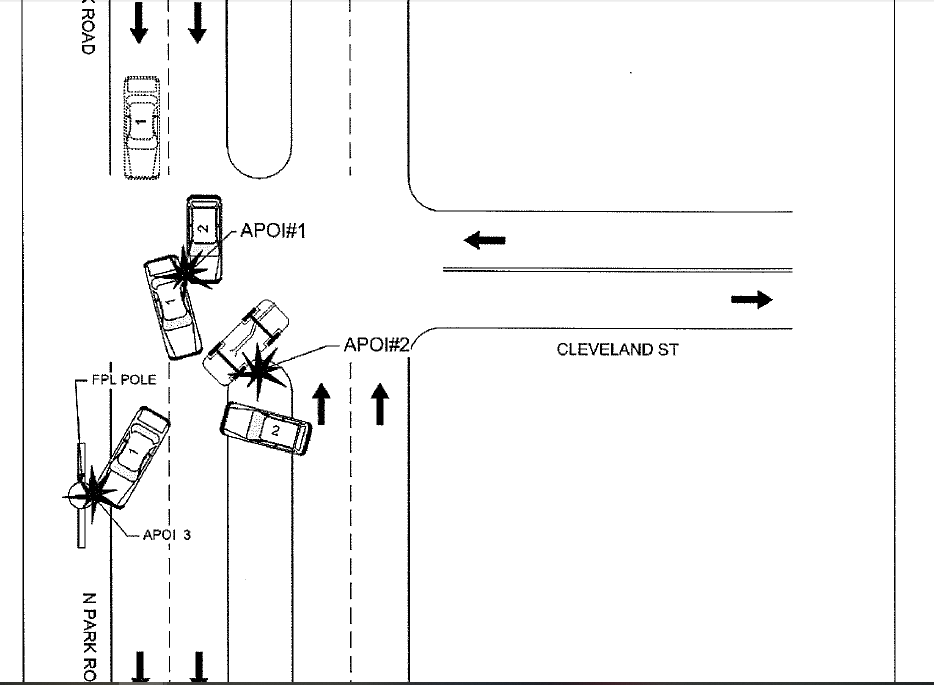

In 2021, Pierre was driving a company car near Orlando, Florida at night. He was heading west. (In the above diagram, Pierre’s car is #2.)

John was driving a van heading East. That car is #2 in the diagram above. Pierre made a left hand turn to pull into a gas station.

While doing so, John’s van hit Pierre’s car almost head on. Pierre claimed that John’s van had its lights off. The crash report said that an independent witness said that he couldn’t see the van.

As a result of the crash, the airbags in Pierre’s car deployed.

Paramedics took Pierre to the hospital.

There, a doctor took an x-ray of his finger.

It showed that his finger was broken.

The doctor put a cast on Pierre’s finger:

USAA insured the other driver on his personal car.

At the time of the accident, the other driver was driving a rental car. However, he didn’t purchase rental car insurance.

Fortunately, Pierre did not need surgery to his finger.

Pierre also had neck pain. An MRI of his neck showed that he had a C6-7 broad based central posterior disc herniation resulting in impingement of the thecal sac.

The same cervical (neck) MRI said that Pierre had straightening of the normal cervical lordotic curvature which can be seen with muscle spasm due to ligamentous sprain and disc Injury.

I got USAA to pay us the other driver’s $50,000 bodily injury liability policy limits.

I think that USAA likely felt that the pain and suffering value of this case was over $36,000. I say this because the final medical bills were almost $14,000.

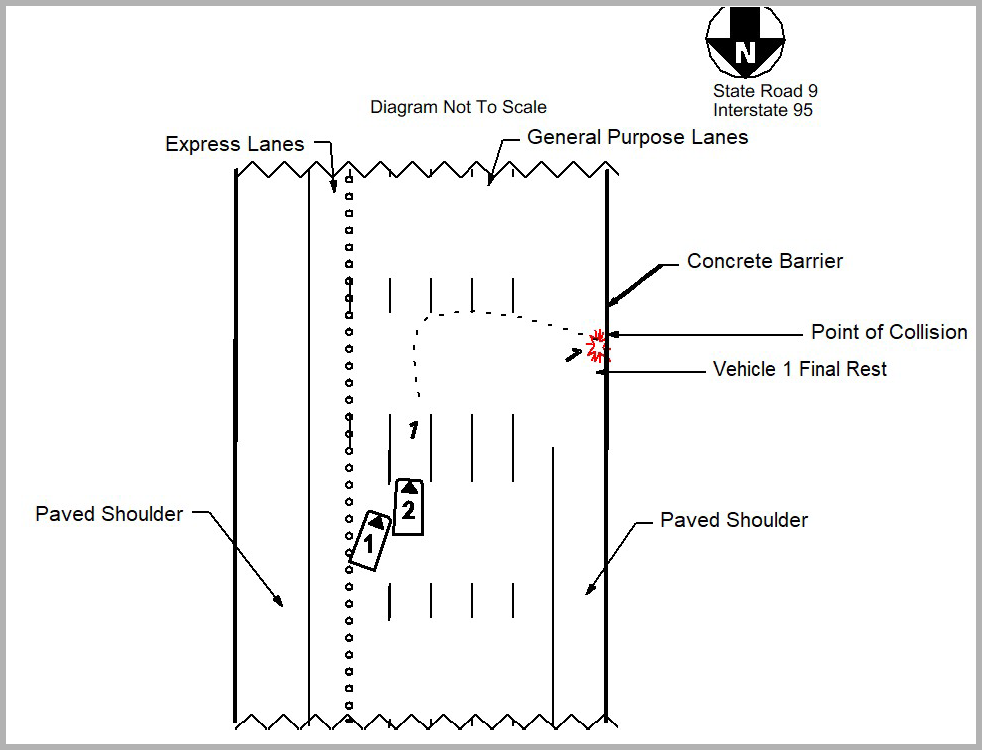

$50K Auto Accident Settlement (2021)

Eddie was driving his pickup truck in I-95 in Broward County, Florida. The front of another vehicle crashed into the driver’s side of Eddie’s truck.

As a result, Eddie lost control of his pickup truck. He crashed into concrete barrier. The other driver left the scene of the accident.

Here is the diagram from the crash report:

As you can see from the damage to Eddie’s truck, this was a heavy impact crash:

The photo below shows that the front of Eddie’s truck was badly damaged:

As a result of the accident, Eddie had tears in the ligaments of his foot. He did not have foot surgery.

Fortunately, Eugene had $50,000 in uninsured motorist (UM) insurance with GEICO.

I demanded the policy limits from GEICO, and GEICO paid us the $50,000 policy limits.

$50K Settlement for Motorcycle Rider Hit by Car

Pat was riding his motorcycle heading north in a parking lot. The parking lot was located in Land O Lakes, Florida. Land O Lakes is in Pasco County, Florida.

Roy was driving a car heading west in the same parking lot. He turned left into Pat’s direct path. To avoid the collision, Pat laid his “bike” down on its left side.

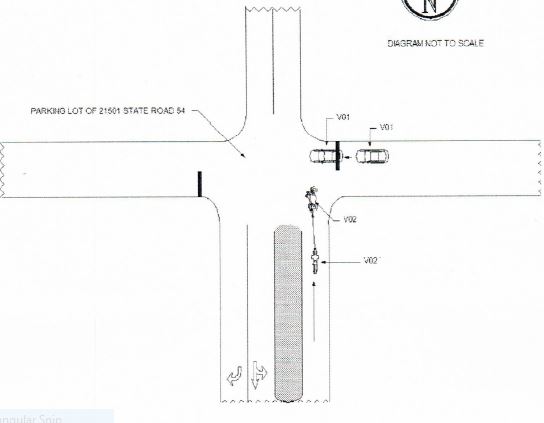

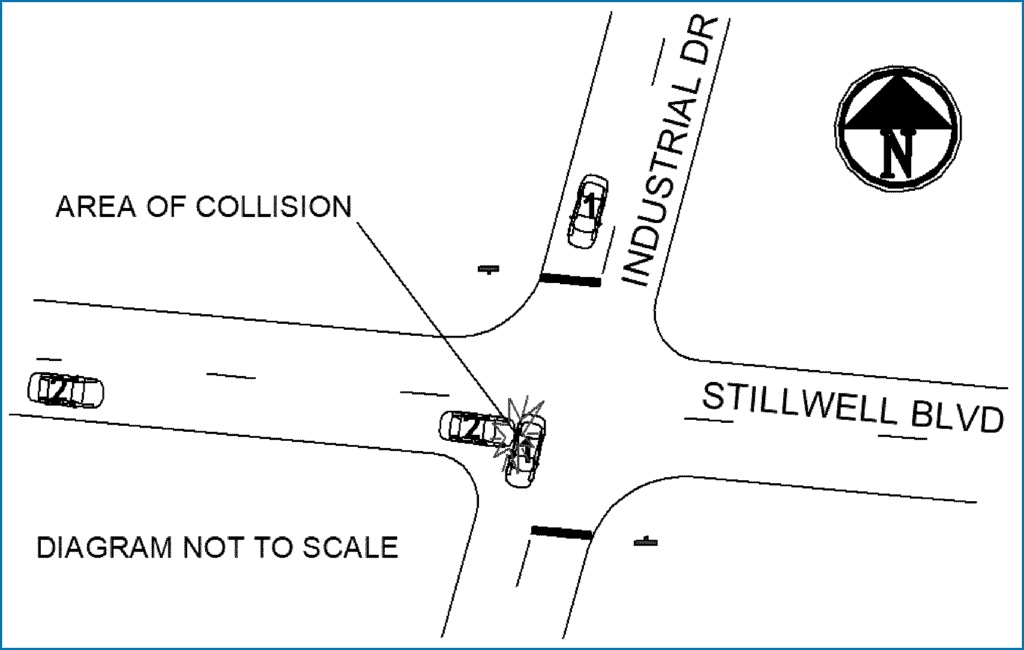

Here is the actual diagram from the crash report:

Before the Florida Highway Patrol Trooper arrived on the scene, the vehicles were moved.

If you have the opportunity, take photos of the motorcycle’s location after the accident. In addition, take photos of the other vehicle as well. This can defeat the other driver’s argument about how the accident happened.

The trooper didn’t give anyone a ticket for causing the accident. His reasoning was because the crash occurred in a private parking lot. Additionally, the trooper said that there were no official traffic control signs.

An ambulance took Pat from the accident scene to the hospital.

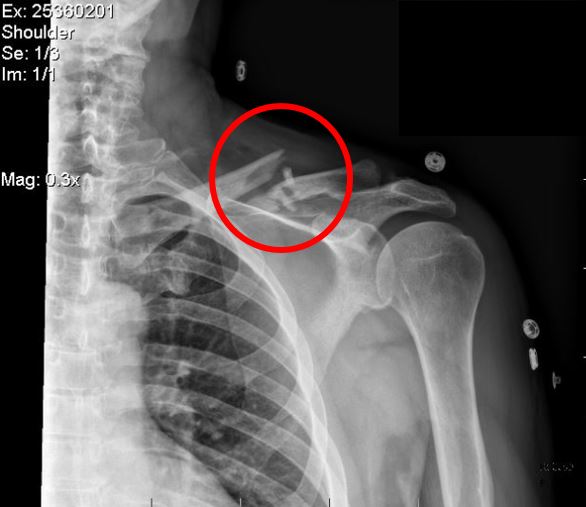

X-Ray Showed a Broken Collarbone

At the hospital, he was diagnosed with a collarbone (clavicle) comminuted fracture. A comminuted fracture is a break or splinter of the bone into more than two fragments.

All things equal, a comminuted fracture is worth more than a simple fracture.

Here is the x-ray of the motorcycle rider’s fracture:

Pat didn’t know his rights. He wanted compensation for his injuries and motorcycle damage.

Therefore, he hired a Florida motorcycle accident lawyer. Fortunately, he hired attorney Justin “JZ” Ziegler of our law firm.

Attorney JZ told him to take photos that showed any bruising on his body. He took a photo that showed bruising to his collarbone and chest.

He had bruising in his collarbone area, and on his chest.

The good news for Pat?

He did not need surgery to fix his broken collarbone. He went to a few visits with his orthopedic doctor. Pat attended physical therapy to help his shoulder’s range of motion.

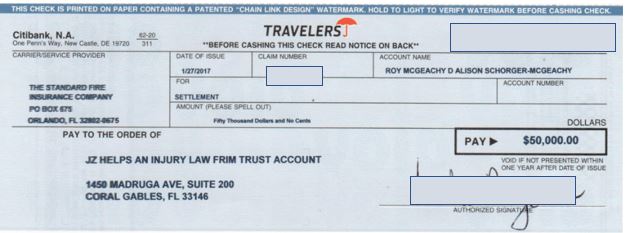

The Standard Fire Insurance Company insured the driver of the car that hit Pat. Standard Fire is part of Travelers. The driver had a $50,000 per person bodily injury liability policy.

This means that the most that Travelers had to pay Pat was $50,000 for his medical bills, and pain and suffering.

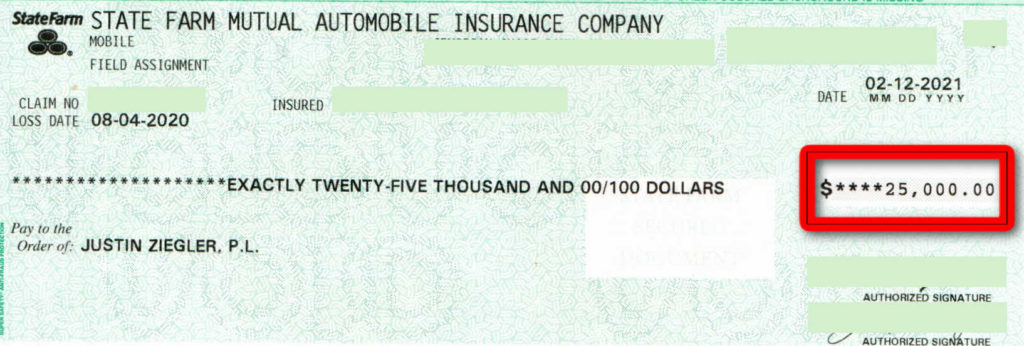

Within just 38 days of the crash, Travelers Insurance Company paid me the $50,000 bodily injury liability insurance limits.

Travelers Insurance Company paid us the $50,000 policy limits. Here is the settlement check:

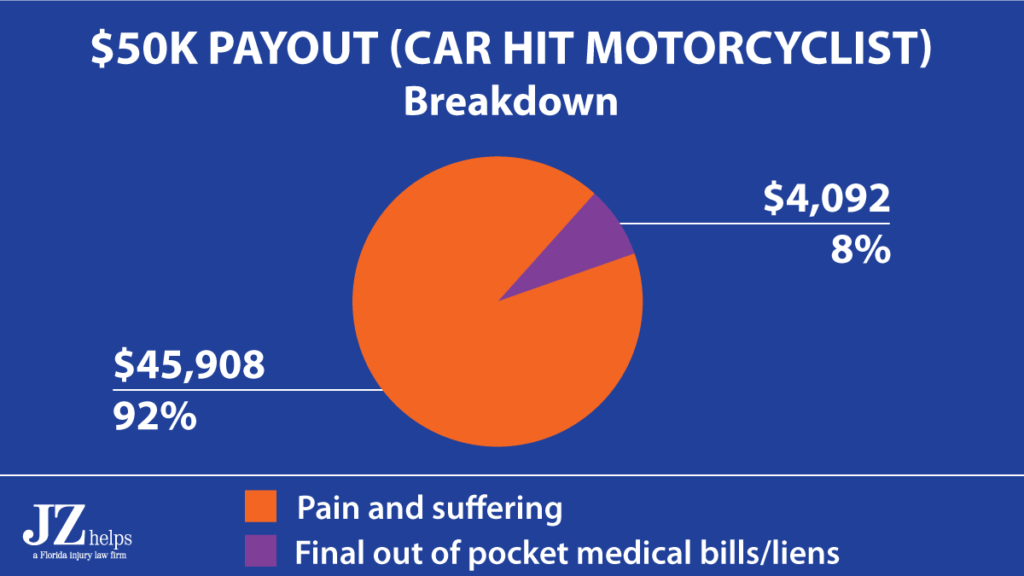

About 92% of the $50,000 settlement was for Pat’s pain and suffering.

Pat had health insurance. His health insurance paid the hospital bill. We paid a under $3,800 back to his health insurance for payments that they made to the hospital and medical providers.

We also had to pay an orthopedic doctor’s office a little less than $400.

How Much Did He Get in His Pocket?

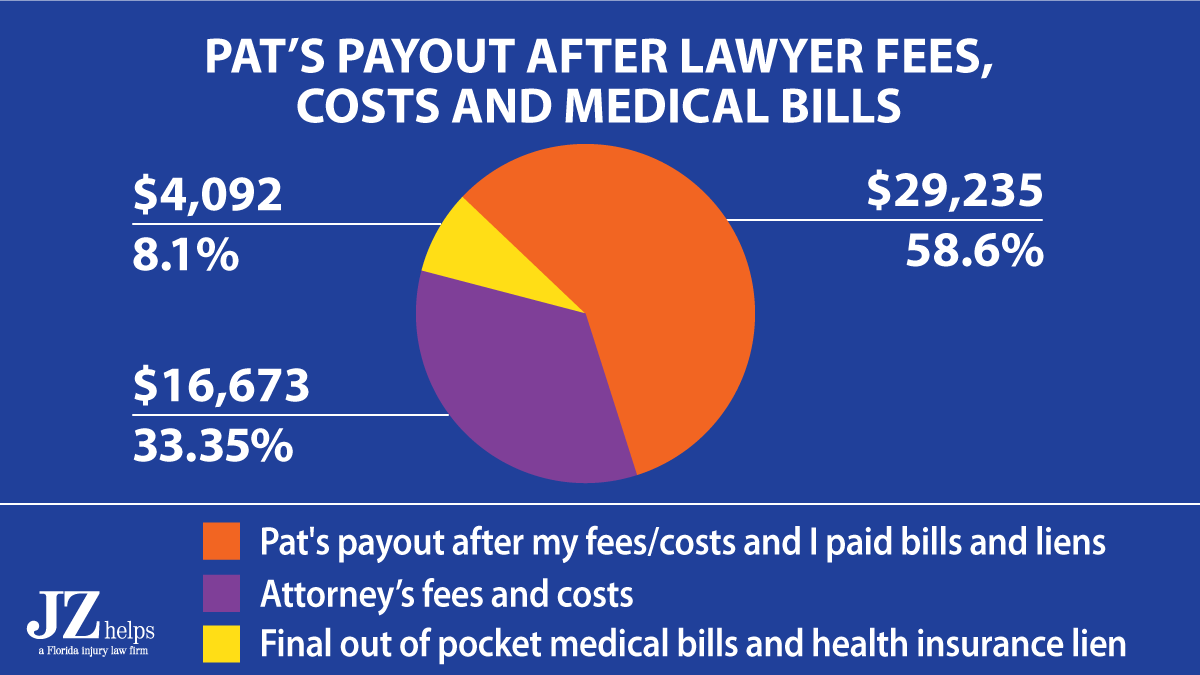

After my attorney’s fees and costs, and me paying his medical bills and health insurance lien, Pat got $29,235 in his pocket. In other words, he got 59% of the payout in his pocket.

The chart below shows this:

$39K car accident injury settlement

For my client, a man in his 30’s, who was diagnosed with a herniated disc in his lower back following an accident. The damage to his pickup truck is below.

The crash happened in Pinecrest, Miami-Dade County, Florida. Before this crash, he received years of chiropractic treatment on the same levels in his lower back that he claimed were injured in this accident.

He was given epidurals to his lower back after this accident. GEICO insured the negligent driver with bodily injury (BI) liability coverage.

My client had uninsured motorist (UM) liability coverage with Star & Shield Casualty (NARS).

North American Risk Services (NARS) handled the claim for Star & Shield.

NARS paid $19,000 to settle the case. This is in addition to the $20,000 settlement with GEICO.

The total settlement was $39,000.

$37,500 car accident injury settlement

A passenger was in a car. Another driver crashed into the car that he was in. As a result, he broke his wrist. Specifically, he had a surgery to fix his distal radius fracture. After the car accident, he hired me as his lawyer.

State Farm, Allstate and a car owner paid me $37,500 for this car accident injury settlement amount.

$35K Car Accident Injury Settlement

Sandra’s employer gave her a car to use for work. In August 2020, Sandra was driving east in Crestview (near Pensacola), Florida. Daniel was in a car heading south. He ran a stop sign.

As a result, the front of Sandra’s car struck the passenger side of Daniel’s car.

You can see the damage to Sandra’s car here:

You can see the actual diagram from the crash report here:

State Farm insured Daniel’s car (#1 in the diagram) with $25,000 in bodily injury liability insurance coverage.

After the accident, Sandra had back and neck pain. She said that her workers’ compensation insurance company gave her limited information about how wage loss worked.

Sandra searched Google for how wage loss works with workers’ compensation. She found my website my website. She got a free consultation with me.

Let Me Fight to Get You a Fair Settlement

After we spoke, she hired me.

An MRI that showed that she had a herniated disc.

Sandra was working at the time of her accident. Thus, her workers’ compensation paid all of her medical bills.

In February 2021, I got State Farm to pay me its driver’s $25,000 BIL insurance policy limits. You can see the check (redacted):

They paid me within about 6 months after the car accident.

It gets better:

USAA insured Sandra’s personal car with $10,000 of uninsured motorist insurance coverage. At the time of this accident, Sandra was not driving her personal car. However, her underinsured motorist insurance (from her personal car) covered her for this accident.

In February 2021, I got USAA to pay me Sandra’s $10,000 limit of uninsured motorist coverage.

The total settlement was $35,000. After my car accident lawyer fees and costs, Sandra gets a check for $23,333.33.

Normally, you have to pay back the workers’ compensation insurance company from your personal injury settlement. However, they must reduce their claim (lien) by your attorney’s fees and costs and other factors.

Here, Sandra’s workers’ compensation lawyer got the workers comp insurer to waive it’s lien. Sandra was happy with our personal injury settlement.

Sandra also settled a workers’ compensation with her employer’s insurance company.

$35K car accident injury settlement (car hit scooter rider)

A scooter rider got $35,000 after a driver failed to yield the right of way and hit him in Miami Lakes, Florida. He suffered an upper leg (femur) fracture.

United Auto Insurance Company (UAIC) paid $10,000. GEICO paid $25,000.

$33K Car accident injury settlement

On July 30, 2018, Shankeva was a passenger in her boyfriend’s (Ken) car.

They were stopped at a red light in Holly Hill, Florida.

In the diagram below, Shankeva was in V3.

Terry was driving vehicle 1. Terry crashed head on into vehicle 2. Vehicle 2 then hit Vehicle 3.

Paramedics arrived at the scene.

You can see them taking Shankeva out of the car.

Below, is a photo showing the damage to the car within which Shankeva was a passenger.

The front of the car was wrecked.

You can see this was a heavy impact accident.

Here is a photo of Shankeva on a stretcher:

An ambulance took her to the hospital.

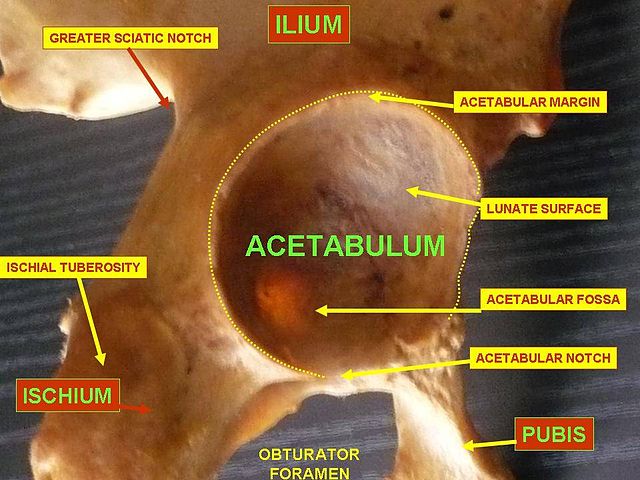

At the hospital, doctors took x-rays, a CT scan and a MRI of her hip.

The x-ray showed an acetabular fracture. Here is what the acetabulum looks like:

Since she had this fracture, they had her stay (inpatient) at the hospital.

They gave her a room.

While at the hospital, someone took a photo of her:

After she was released from the hospital, she had to use a walker to get around.

Here is a photo of Shankeva using a walker:

Ultimately, she made a great physical recovery. She was able to walk without needing any devices.

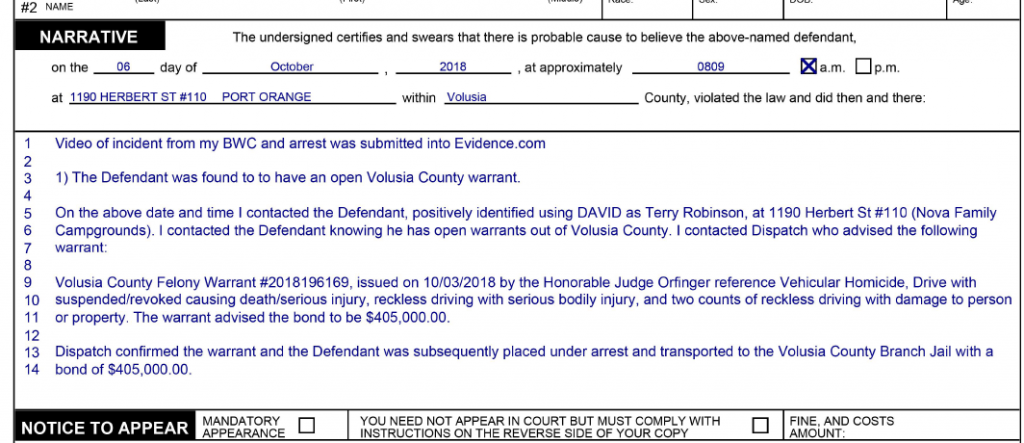

At fault driver sped up before the car accident

I wanted to get Shankeva the best possible car accident injury settlement. To do this, I searched online to view the criminal public records in Volusia County. I downloaded the charging affidavit of the driver of vehicle 1 (Terry).

Here is a portion of the charging affidavit:

Like many cases, there was limited insurance available. Fortunately, the car that Shankeva was in had $25,000 in uninsured/underinsured motorist (UM/UIM) insurance. I put pressure on State Farm to pay me.

The result?

Within 30 days of the accident, State Farm sent me a check for the $25,000 UIM injury coverage limits.

Additionally, the at fault driver’s BIL insurer (Windhaven) paid us $8,000. Windhaven paid Shankeva’s boyfriend $2,000. The most that either Shankeva or her boyfriend could get from Windhaven combined was $10,000.

My client’s total settlement payout was $33,000. Approximately, $31,000 of the settlement was for her pain and suffering damages.

The rest of the settlement was for medical bills and her Molina Medicaid insurance lien. I was able to get Molina Medicaid to reduce its lien (payback amount). Without a lawyer, they would not have reduced their lien.

After my attorneys fees and costs, Shankeva got around $22,000 in her pocket. I think that the total amount of this car accident injury settlement is great given the limited insurance.

$33,000 Settlement for a Bicyclist Hit By a Car

A bike rider, sustained a meniscus tear and tibia plateau fracture, as a result of being hit by a car while he was riding his bike.

He basically had no limitations following the healing of his injuries.

$30K Car Accident Settlement (Orlando, Florida)

Check out a $30,000 settlement after a driver was rear ended in Orlando, Florida. She claimed that the accident caused a meniscus tear in her knee.

USAA insured the at fault driver. In October 2005, USAA paid $30,000 to settle the case.

$28K Auto Accident Settlement (Hit and Run)

In 2020, Cordario was driving his car in Flemington, Marion County, Florida. A driver crashed into the back of Cordario’s car. This sent Cordario’s car off the side of the road where he struck a pole.

His airbag did not deploy. The other car left the scene of the accident.

An ambulance took Cordario to Shands Hospital in Gainesville, Florida.

Codario had a traumatic fracture of ulnar styloid with minimal displacement. The ulnar styloid is bone at the end of your forearm closest to the wrist. Cordario did not need surgery for this broken bone.

This was not a serious fracture. In fact, the hospital radiologist said that the x-ray showed that he may have a small and difficult to see avulsion fracture. He was not certain that it was a fracture.

He searched for us from the hospital. I gave him a free consultation.

Let Me Fight to Get You a Fair Settlement

After we spoke, he hired me. Cordario also had lower back pain. He received physical therapy for it.

Progressive insured Cordario’s car with uninsured motorist insurance. In 2021, I settled his personal injury case with Progressive for $28,000. After my lawyer fees, costs and paying his medical bills, we gave him a check for $15,496.

He gave us this review:

Lying in the hospital bed I wasn’t even sure if i even had a case for a hit and run accident. I searched for hit and run lawyers and Justin was the first name to come up. I watched his videos and testimonies. Justin and Jenny [paralegal] were awesome. They kept me up to date during the whole process. There was never a grey area. Things got really tough financially for me and Justin came in clutch at the right time. This process was as smooth as can be. Thank you guys so much for your help.

Google 5 star review on April 12, 2021

$28K Settlement for Bulging Discs and Other Injuries (Truck Accident)

Tom, a 51 year old, was driving a box truck on I-75 in Wildwood, Sumter County, Florida. Jose was driving an 18 wheeler truck headed in the same direction.

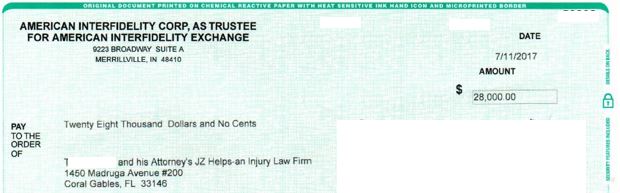

The front of Jose’s truck hit the back of Tom’s truck. American Inter-Fidelity Exchange insured Jose’s employer.

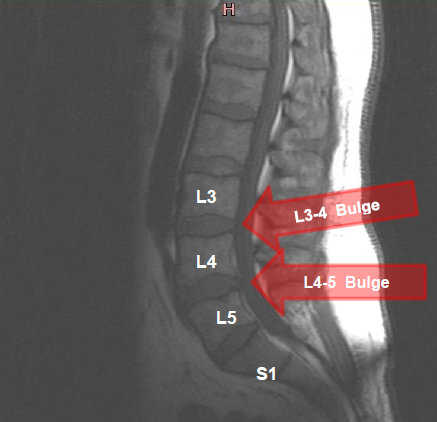

We claimed that the accident caused or aggravated pain in Tom’s neck, back and elbows. The doctor ordered an MRI of his lower back. The MRI showed bulging discs. An MRI image is below:

We also claimed that the collision worsened the chondromalacia in his knee. An MRI of his knee is below.

Chondromalacia patellae, also known as “runner’s knee,” is a condition where the cartilage on the undersurface of the patella (kneecap) deteriorates and softens.

American Inter-Fidelity Exchange paid $28,000 to settle Tom’s injury claim.

We represented Tom.

$26,000 Settlement

In a car accident for a passenger that was rear ended. He treated with chiropractors for over a year before having an MRI on his back.

An MRI revealed a herniated disc effacing (pressing on) the spinal cord. My client lives in California and the accident occured before he was about to get on a cruise ship.

We have settled three (3) other claims for his wife and kids who were in the car at the time of the car crash. This client is one of the numerous clients that we has represented that doesn’t live in Florida.

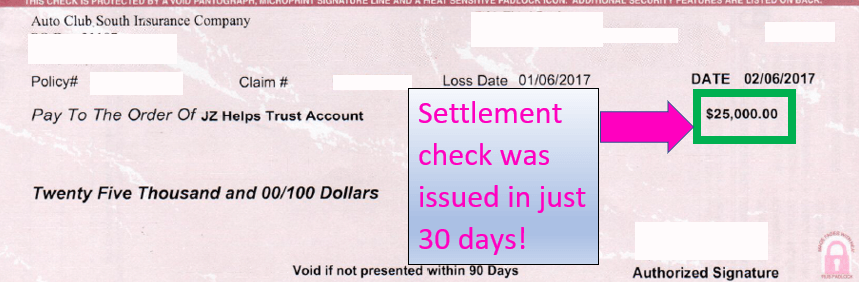

$25K Car Accident Injury Settlement (In Just 30 Days!)

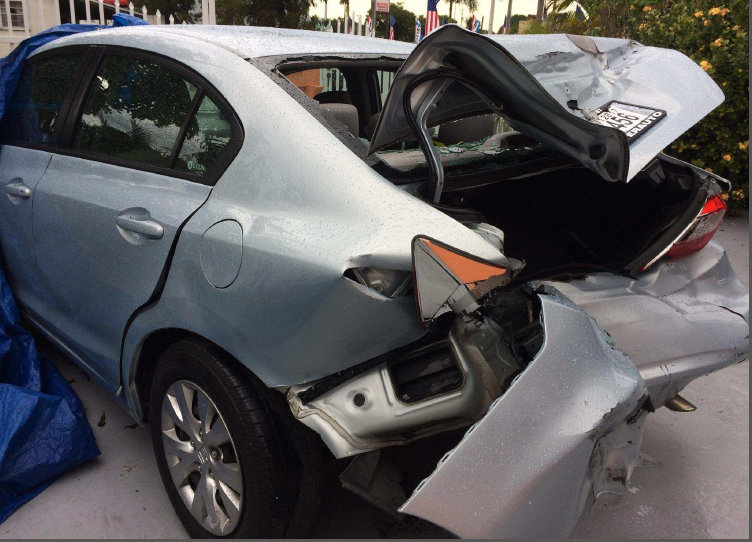

Odalys was a passenger was in a car accident in Hialeah, Miami-Dade County, Florida. Another car hit the back of the car that she was in.

In both the photos above (and below), you can see that there was big damage to the car that Odalys was in.

The crash report said that she was wearing a shoulder and lap belt at the time of the crash.

An ambulance took her to the hospital from the accident scene. However, the hospital medical record said that she was unrestrained (not wearing a seat belt) at the time of the accident.

Why does this matter?

If you’re not wearing a seat belt, and you’re injured, the insurance company may offer you less money to settle your personal injury case.

At the hospital, she complained of neck pain.

There, they took X-rays were taken of her nose, chest and pelvis. CT scans were taken of her head and brain, and her neck (cervical spine).

The x-rays and the CT scans didn’t reveal any injuries.

She had a few follow up medical visits with a doctor. She had soft tissue injuries.

Shortly after this rear end accident, Odalys got a free consultation with me. After we spoke, she hired me.

Unfortunately, Odalys wasn’t entitled to Personal Injury Protection (PIP) insurance. This is because she didn’t own a car, or live with a relative who owned a car.

The driver of the car that Odalys was in – at the time of the crash – gave an Infinity Car Insurance card to the police officer.

I made a claim with Infinity, who said that the owner failed to add the car to the existing insurance policy. Thus, Infinity denied the claim.

This meant that the medical bills needed to be paid from the personal injury settlement, which I’ll discuss shortly.

Hospital Lowered Bill from $16,500 to $7,500

The hospital bill was over $16,500. We asked them to reduce it. They reduced it to $7,500.

Auto Club South Insurance Company insured the careless driver. He had a $25,000 per person/$50,000 per accident BIL policy. The Auto Club claims adjuster was Stephanie Schmitt.

I reminded her that she had a duty to act in good faith to her insured. I also pointed out to her that there was limited insurance coverage.

Auto Club hired attorney Andrew Stone of Stone, Glass & Connelly to decide how to divide up the $50,000 per accident BIL insurance limits.

They paid $25,000 to Odalys to settle. This is the maximum that any one person injured in the accident could get from Auto Club.

I got AAA to issue the settlement check within 30 days of the accident. You can see the check below:

The settlement is higher than the average settlement for a rear end crash. There were 4 reasons for this:

- There was major damage to the car that she was in.

- She had a big hospital bill.

- AAA is a decent car insurance company.

- There were 3 people in the car that Odalys was in.

Most of the settlement was for her pain and suffering.

$25K Car Accident Injury Settlement

This is a different passenger’s settlement arising from the same crash above. Auto Club Insurance Company paid another passenger $25,000 to settle his soft tissue injury claim.

The accident was in Hialeah, Miami-Dade County. I represented him.

$25,000 Settlement for Aggravation to Pre-Existing Shoulder and Other Injuries

My client claimed that a car crash caused his shoulder, wrist, back, knees, ankle and neck pain. Another driver was cited for careless driving.

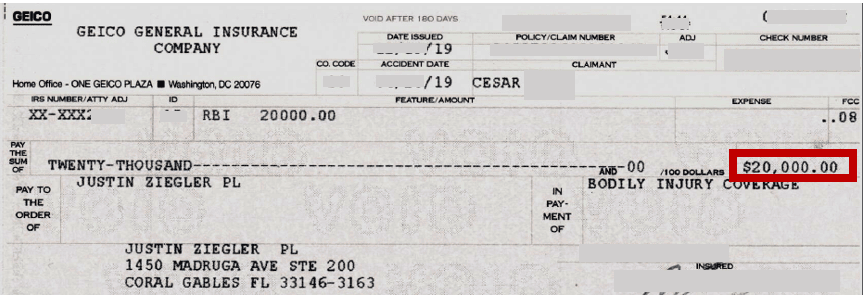

The careless driver was uninsured. My client had $25,000 in uninsured motorist (UM) coverage with USAA.

USAA paid $25,000. Here is the settlement check:

The accident happened in Key Largo, Miami-Dade County, Florida.

$25,000 Car Accident Injury Settlement

A drunk driver (insured by State Farm) crashed into a car within which our client, a young lady, was a passenger. Our client’s injuries were neck, back and leg pain.

We settled for the bodily injury liability coverage limits of $25,000. Location of Accident: Miami, Florida. Date of Settlement: January, 2014.

$25K Settlement

For a young woman who was a passenger in a car that slammed into the car in front of it. Her injuries were cervical, thoracic and lumbosacral spine chronic sprain/strain injuries.

Another personal injury that she suffered was a C6-C7 posterior disc herniation and Bilateral broad-based bulging discs C3-C4, C4-C5. She also had Bilateral feet and toes paresthesia. The policy limits for the driver insured by State Farm were $25,000.

My client did not have underinsured motorist insurance which would have resulted in a much larger payout for my client.

$25K Car Accident Settlement

For an elderly Cuban-American businessman who suffered a broken (fractured) tibia (lower leg bone) when he was hit by a driver insured by State Farm Insurance Company.

The accident occured in Hialeah, Florida. My client did not purchase undersinsured motorist insurance coverage which would have resulted in a larger payout for my client.

$25K Settlement (Policy limits)

For a driver (insured by USAA) in Miami, Florida who had soft tissue injuries as a result of being rear ended by a truck.

$20K Settlement for Florida Car Accident (2019)

In April 2019, Cesar was driving his minivan on his way to his condo in Brickell, Florida. Brickell is near Downtown Miami. Cesar was on the road outside of his condo and was about to enter the driveway.

A driver of a car crashed into the back of Cesar’s van. This impact sent him (and his minivan) into a concrete wall at the entrance. This was a second impact. In sum, this was a heavy impact accident. The van’s airbags deployed.

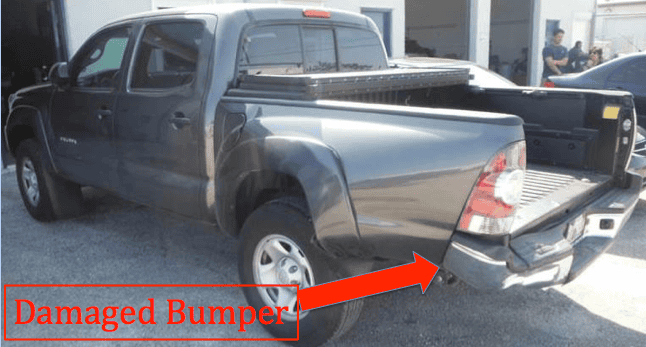

Here is what Cesar’s minivan looked like after the crash:

The driver of the (other) car got a ticket for careless driving.

Paramedics arrived to the accident scene. They placed him on a backboard and put a C-collar on his neck. They transported Cesar to the hospital. At the hospital, he was placed on a rolling bed.

Here is a photo:

Take Photos if Paramedics Put a “C-Collar” on Your Neck

If the paramedics put a cervical collar on your neck, ask someone to take a photo of you. It is best if the photo is taken in landscape view (sideways). This photo is powerful. It may get a car insurance company to offer you more money for pain and suffering.

Also, if the staff at the hospital puts you in a bed, get someone to take a photo of you. Again, this photo can be very powerful and help get the case settled with GEICO for fair value.

The good news for Cesar’s health?

He did not have any broken bones. Basically, he had soft tissue injuries. He had pain in his knee, neck and back. GEICO insured the car whose driver got a ticket.

After the accident, Cesar searched online for a car accident attorney near Brickell, Florida. My office is in Coral Gables, which is a 20 minute drive from Brickell.

Cesar told me that we were not the #1 or #2 result in Google’s search results for the term that he entered. In fact, before contacting my office, Cesar reached out to the law firms that appeared in the #1 and #2 search results on Google.

However, he also saw our great reviews on Google Maps. Cesar got a free consultation with me over the phone.

When we spoke, he felt that we clicked. He also said that in my videos I give an easy to understand explanation of how rear end accident cases are handled. Immediately after we spoke, I sent him my simple electronic fee contract. He hired me.

Cesar received medical treatment for his soft tissue (neck, back and knee) injuries. However, he did not get an MRI of his spine. His orthopedic doctor felt that he did not need an MRI since his back and neck pain pretty much went away.

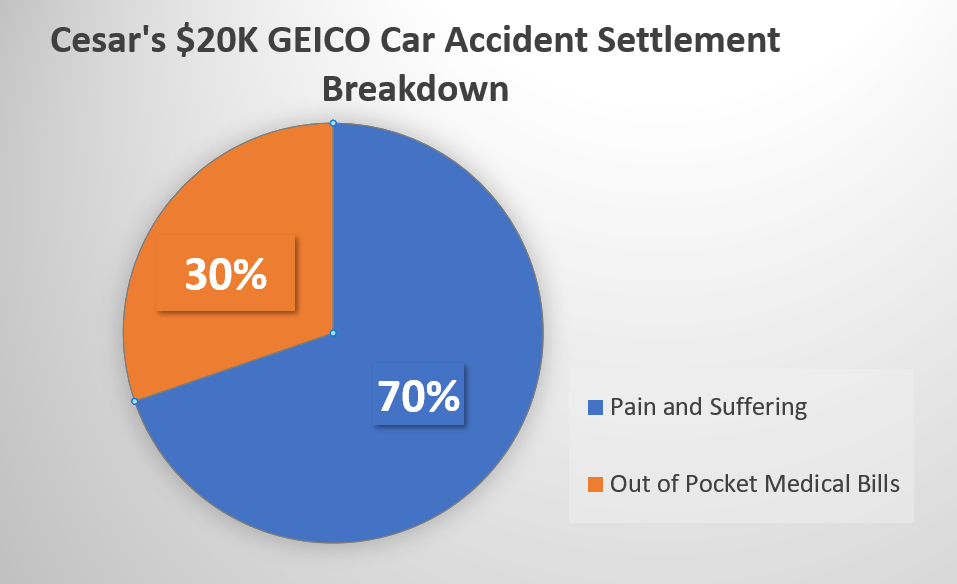

70% of the Settlement is for Pain and Suffering

Cesar had insurance on his van with United Auto Insurance Company (UAIC). UAIC took his recorded statement (with me also on the phone). Cesar’s personal injury protection (PIP) on his car insurance paid $10,000 to the hospital and his medical providers.

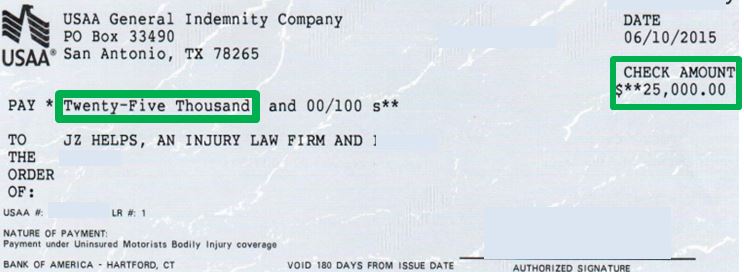

In December 2019, I settled Cesar’s personal injury case for $20,000. Take a look at GEICO’s settlement check:

Basically, we settled the case in less than 9 months after the crash.

About 70% of the total settlement was for his pain and suffering. The rest of the settlement was for his medical bills.

Take a look:

After my attorneys fees and costs, and paying all of his medical bills, Cesar got over $7,250 in his pocket.

Check it out:

Keep in mind that this $20,000 settlement is much higher than the average car accident settlement in Florida. Why is it much higher?

For two reasons.

First, Cesar’s van sustained a huge amount of damage. Car insurance companies pay more money for pain and suffering if your vehicle is badly damaged.

Second, an ambulance took him to the hospital from the accident scene. Car insurance companies) pays more money for pain and suffering if you take an ambulance to the hospital from the accident scene.

Cesar told us that we did a Good job. Here is a photo of him smiling after he came to my office (in Coral Gables) to get his settlement check:

We likely would have gotten a bigger settlement if he would have had an MRI of his neck and/or back. However, the doctor did not feel that this was necessary.

Why not?

His pain did not shoot down to his arms or legs, and his localized back pain was not severe.

$20K Accident Settlement

Yolanda was driving her SUV in Hollywood, Broward County, Florida.

Another driver (Beverly) made an improper lane change into Sara’s lane. This caused the car’s right rear to make contact with the SUV’s right front.

After contact, Beverly’s car came of the road and struck a stationary object. After Yolanda’s SUV was hit by the car, her SUV ran off the road. It then rolled over and came right side up.

Here is a crash diagram. Yolanda is vehicle 2 in the diagram. Beverly is vehicle 1.

Above, you can see a photo of the damage to Yolanda’s SUV. Here is a photo of the damage to Beverly’s car.

The community service officer (CSO) noted in the traffic crash report that there were tire marks on the road indicating that Beverly’s car was partially in Yolanda’s lane.

Paramedics transported Yolanda via ambulance to the hospital. The CSO determined that Beverly was at fault for the crash.

After the accident, Yolanda got a free consultation with me.

Let Me Fight to Get You a Fair Settlement

After we spoke, she hired me. She had MRIs to her spine, and her knee. Doctors diagnosed her with a herniated disc, ACL sprain/tear and more.

Windhaven insured Beverly’s car. They paid us $10,000 to settle. They have since gone out of business.

GEICO insured Sara’s with $10,000 in non-stacking underinsured motorist (UIM) insurance. GEICO paid me the $10,000 UIM limit. Take a look at GEICO’s settlement check:

In sum, we settled Yolanda’s personal injury case for the $20,000 policy limits.

$20K Settlement for car accident (soft tissue injuries)

See a case where a driver got $20,000 after a truck hit him. He claimed a concussion, injury to his shoulder, spine & loss of sensation to his fingertip.

$20K Settlement for Car Accident

Lisa (not real name) was in a car that was T-boned by another car at an intersection in Miami-Dade County, Florida. We claimed that the accident caused or aggravated a herniated disc in her lower back.

She also claimed that the crash caused a small scar on her body. Infinity Indemnity Insurance Company insured the other driver.

Infinity paid the $10,000 bodily injury (“BI”) liability insurance limits. Another insurance company paid its $10,000 UIM insurance limits.

We represented Lisa.

$20K Settlement for Car Accident Injury

Henry (not real name) was in a car that was T-boned by another car at an intersection in Miami-Dade County, Florida. We claimed that the accident caused or aggravated a herniated disc in her lower back.

Infinity Indemnity Insurance Company insured the other driver. Infinity Indemnity Insurance Company paid the BI liability insurance $10,000 limits.

Another insurance company paid its $10,000 UIM insurance limits. We represented Henry.

$20K Settlement for Palmetto Bay Car Accident

My client was driving a car when another driver hit her. She had neck pain.

The accident happened in Palmetto Bay, Florida.

$20K Payout for Car Accident

For a Venezuelan woman who was rear ended by another driver. Progressive insured the careless driver, who was cited for reckless driving.

Our client, a mother and wife, received chiropractic care for her personal injury.

An MRI of her neck revealed a disc protrusion (herniation) which indented on the ventral (spinal) cord. She also had multilevel disc bulges. The chiropractor stated that she should meet with an orthopedic doctor to discuss having surgery.

Her daughter and mother was also in her car. We settled her daughter’s car crash claim for $10,000. We also settled her mother’s claim without a car accident lawsuit. (M.D.)

$17,500 Settlement

For a bicyclist who sustained lacerations to her chin and required several staples in her abdomen when a driver (insured by State Farm) hit her. The police officer did not issue a ticket because he felt that my client, the bike rider, and the other driver were at fault.

My client was on her bike riding against the flow of traffic. The insurance company stated that they believed the bicycle rider was responsible for 30% of the accident.

$16,500 Settlement

My client was driving his pickup truck.

A driver failed to yield the right of way. He hit my client. It happened in Miami-Dade County, Florida.

GEICO insured the careless driver.

My client was diagnosed with a herniated disc in his back. GEICO settled the case for $16,500.

$16,000 Settlement

For a woman who was hit by a drunk driver insured by Progressive Insurance. She had back pain and neck pain and treated with a family doctor and rehab facility. She did not have an MRI done. Miami, Florida.

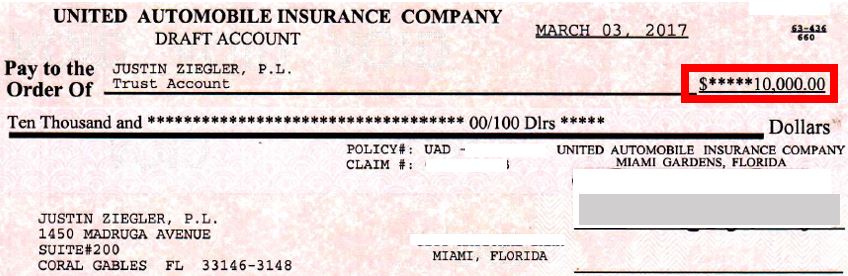

$14,200 Accident Settlement (Car hit bike rider) in 2020